Poetic? Isn’t the stock market about making money?

How is this poetic? Isn’t this just all about buying low and selling high? Where’s the art in that?

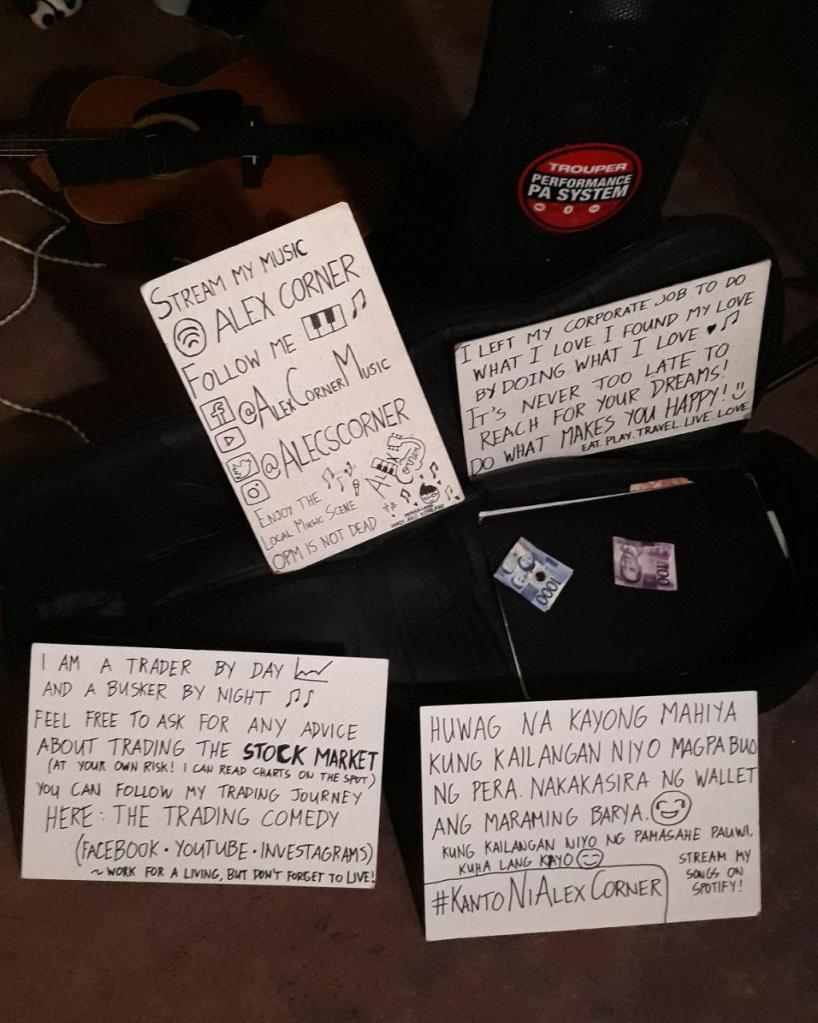

Well yes, but you know what? If I talk about the stock market in financial jargon, it would sound a bit boring and overwhelming. I don’t want you to get succumbed to the idea that the market will make you rich right away (and please don’t leave your day job yet for this involves a lot of time and patience to master, I’m telling you)

So with that said, let me give you different perspectives of what the stock market is. To make it super interesting to you, let’s actually relate the stock market to Dante Alighieri’s Divine Comedy because it is exactly what it looks like:

I know it sounds crazy but it is what it is. So with that said, let the image above represent a planet.

The planet represents the company that you want to go into.

A planet has history and it can be divided into these levels:

Inferno and Limbo can be interpreted as the planet’s bad history.

Purgatorio and Paradiso can be interpreted as the planet’s good history.

So wait, you mean to tell me that the stock market is somewhat a form of literature?

You can put it that way if you want.

Doesn’t it sound entertaining when you think about it? The feeling of entering a planet, exploring it’s past, seeing if there is a possible future for the planet to grow?

Let me give you another perspective: Say you are a general and you have an army at your disposal.

You want your army to explore a planet so what do you do?You send them out on a mission.

But wait! You don’t just send them out there, you need a map!

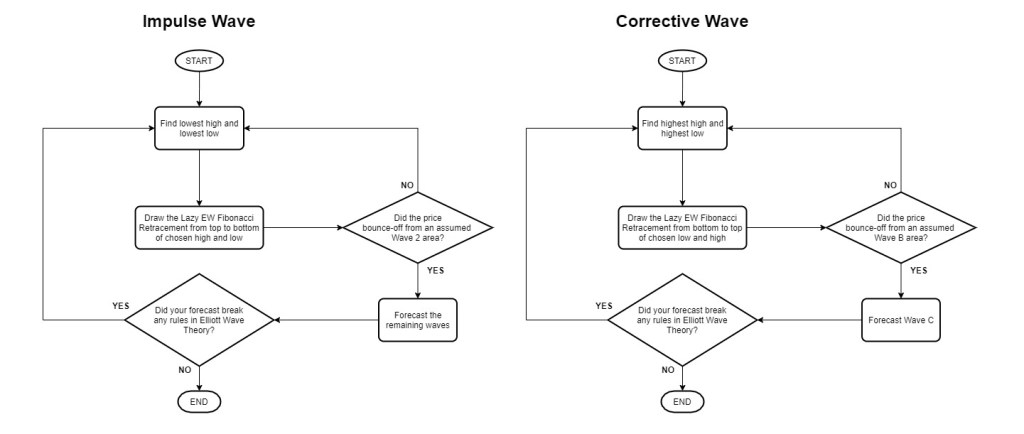

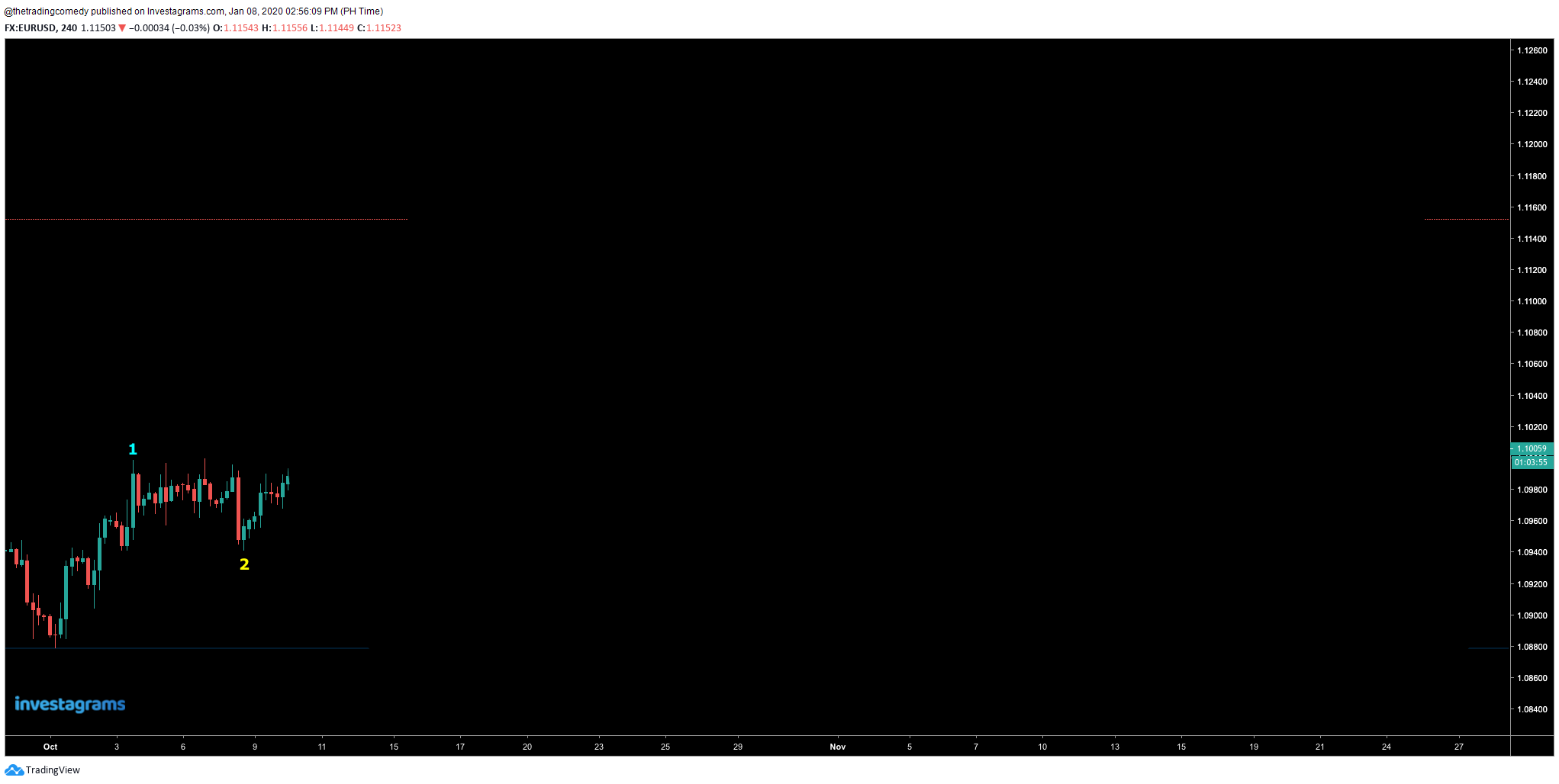

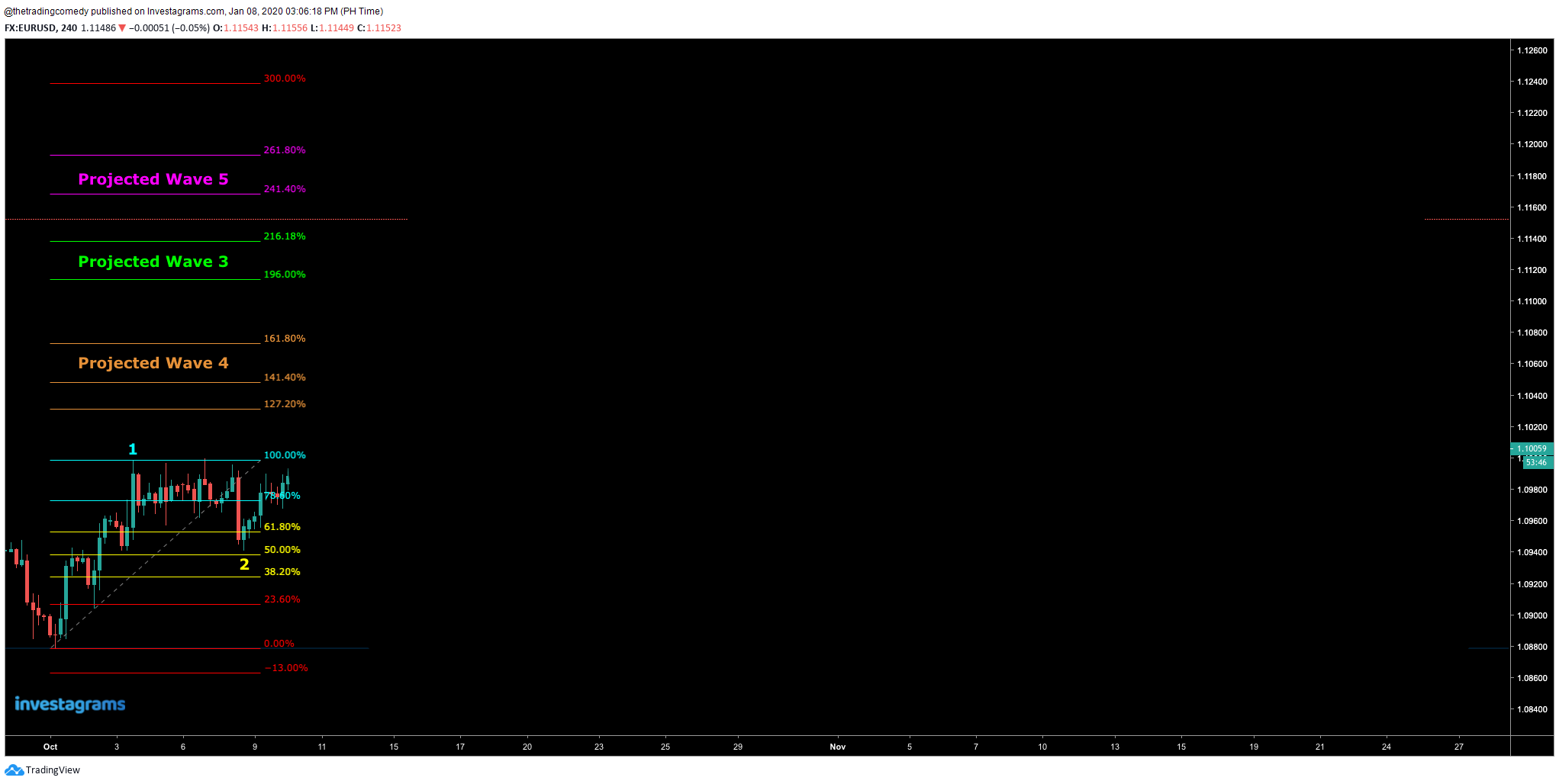

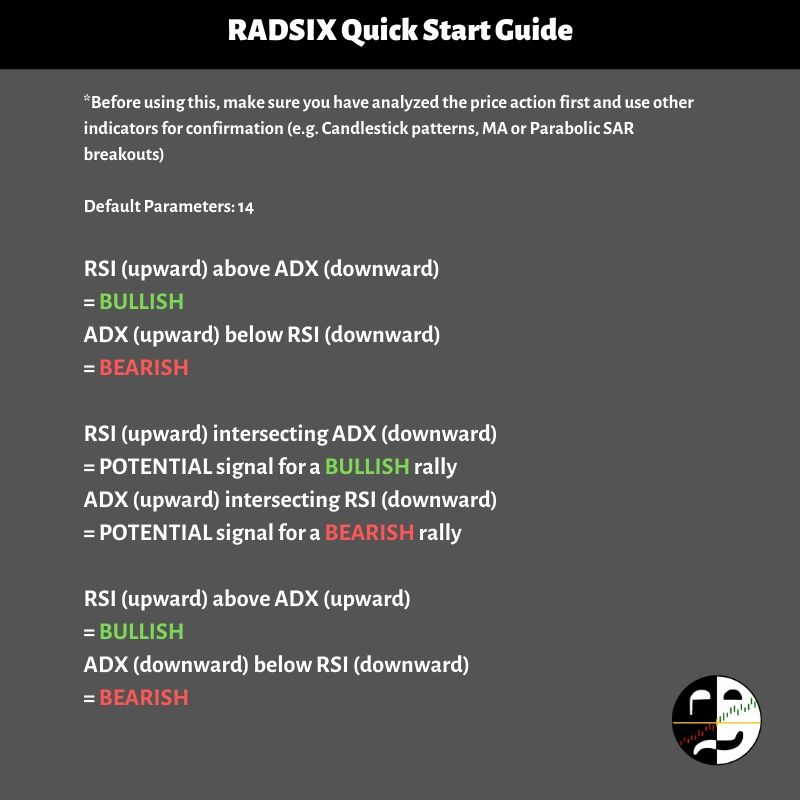

But how do you create that map? There are a lot of ways, but I can give you one very simple way:

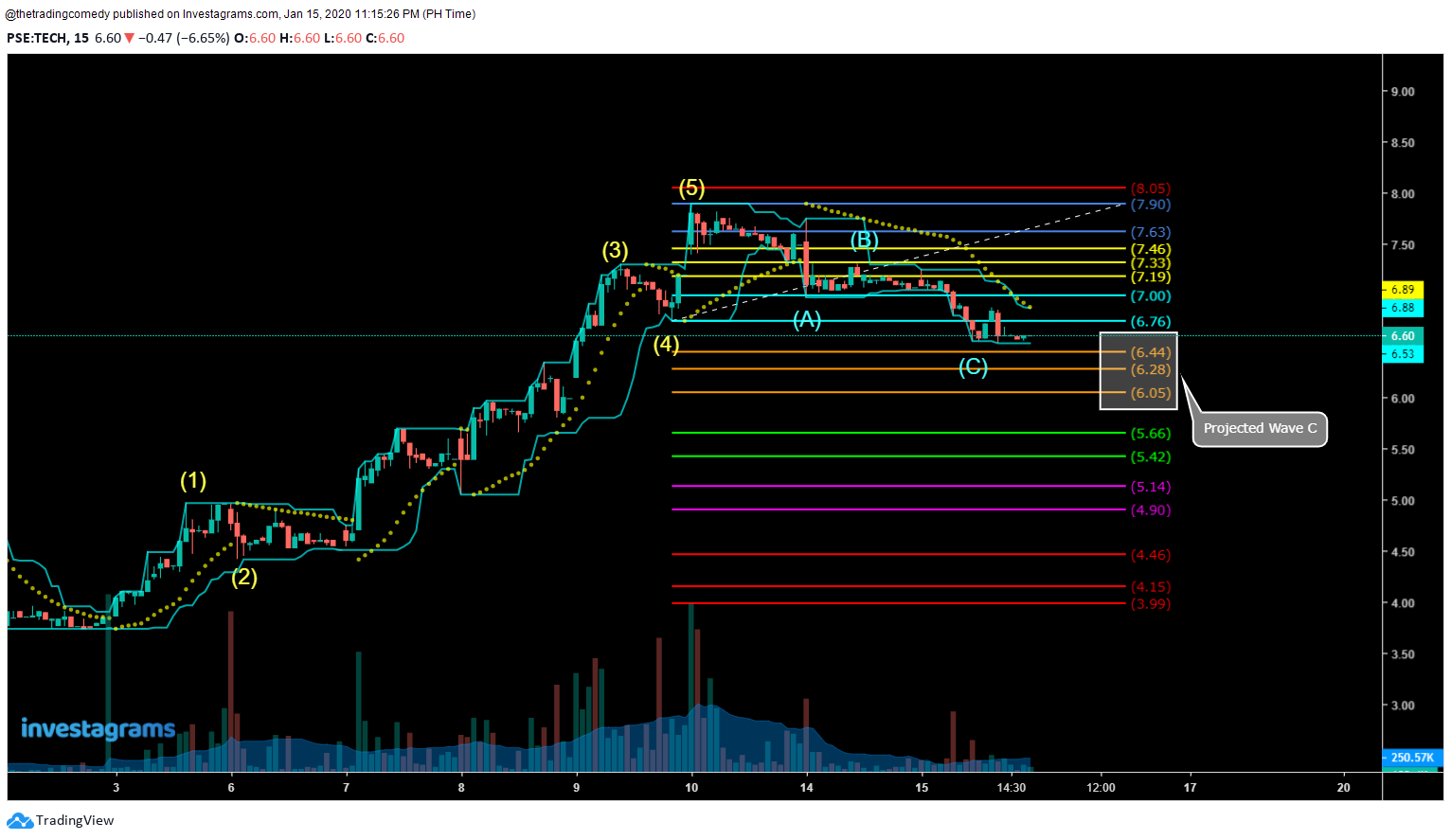

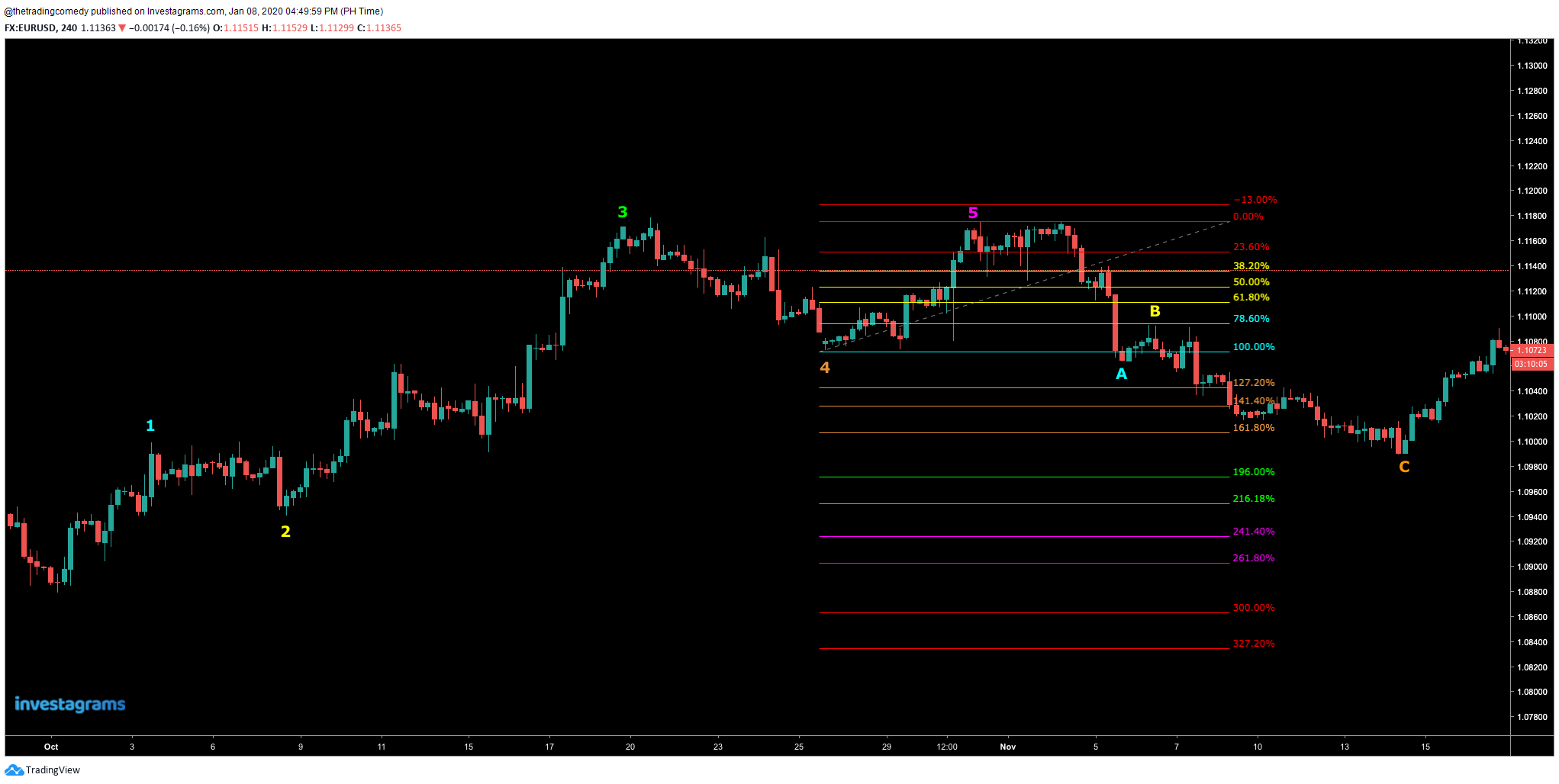

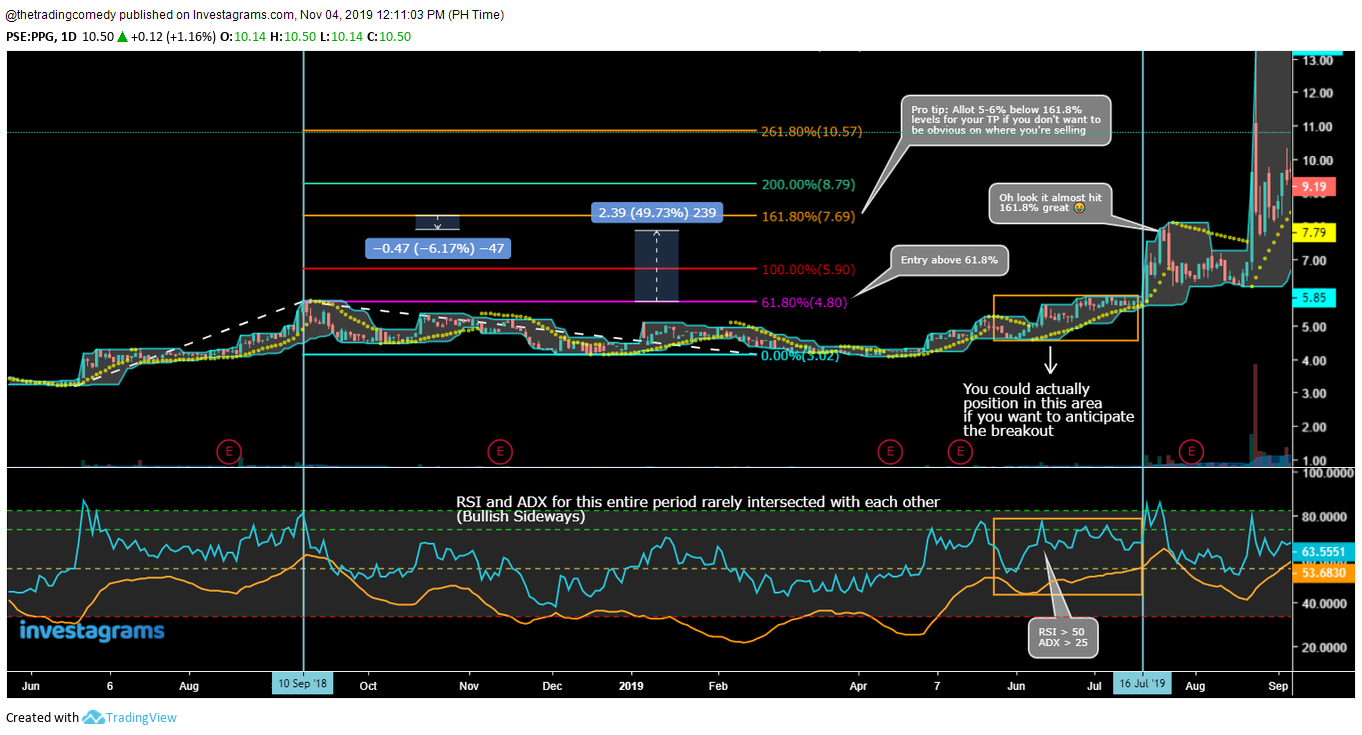

Whoa! How did you determine those plots?

It’s just a matter of looking at the planet’s history. Will you look at that? Here’s what it looks like when you send 23,100 of your troops to planet $JFC.

Creating your plan can actually go as basic as this.

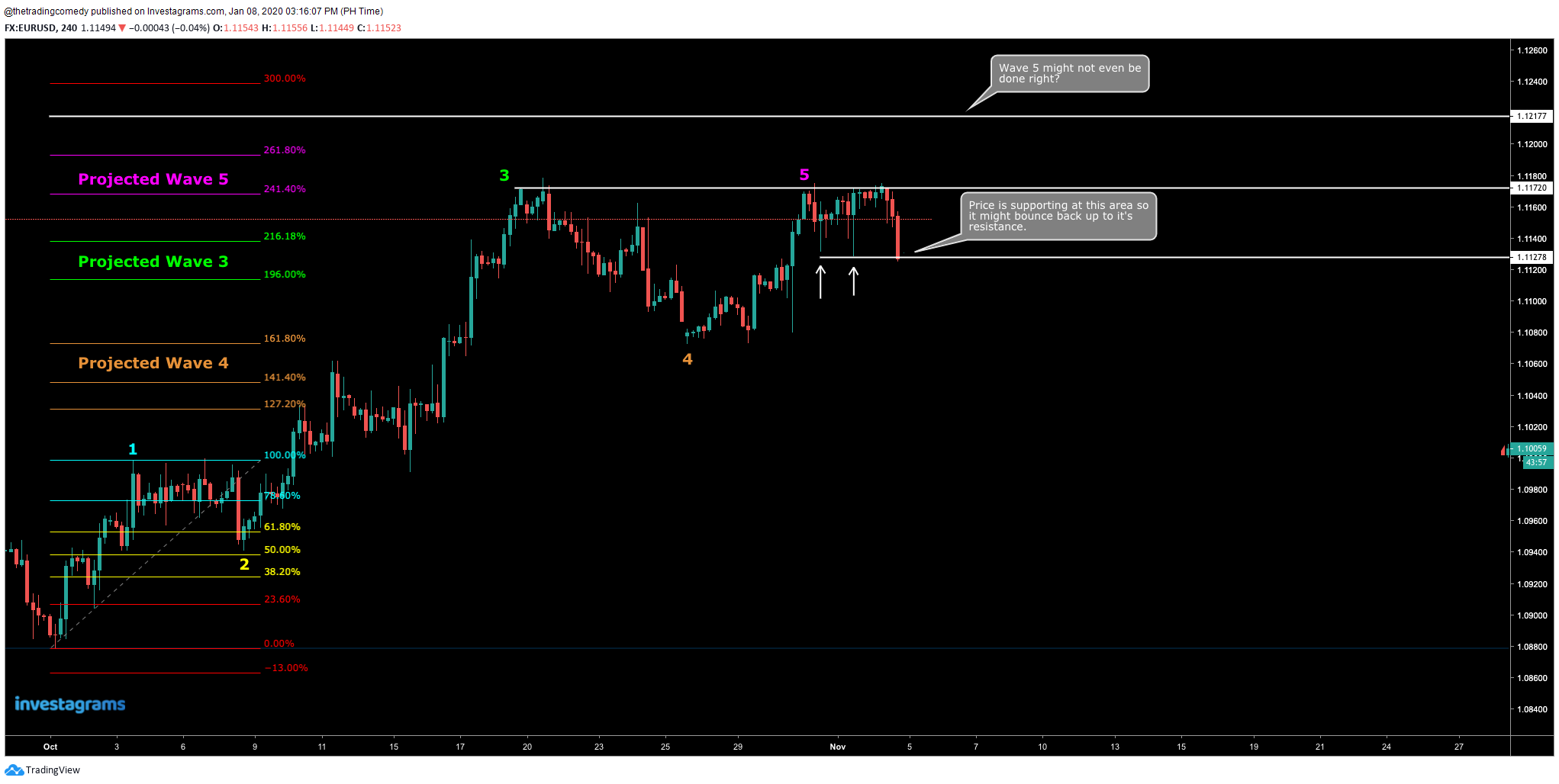

As a general, you should know how to minimize casualties. But what happens if you don’t plan? Maybe something like this:

Oh shit what happened back there? Why did that general lose 2,200 of his men?

Because he didn’t follow the map. The map was perfectly planned and yet he lost. Why you may ask? The general became emotionally invested in his men.

He forgot that the war that he was getting into involves risk. Because of this fear of losing more men, he decided to withdraw his troops.

Damn that’s gotta hurt so what does the general usually do when he suffers that many casualties?

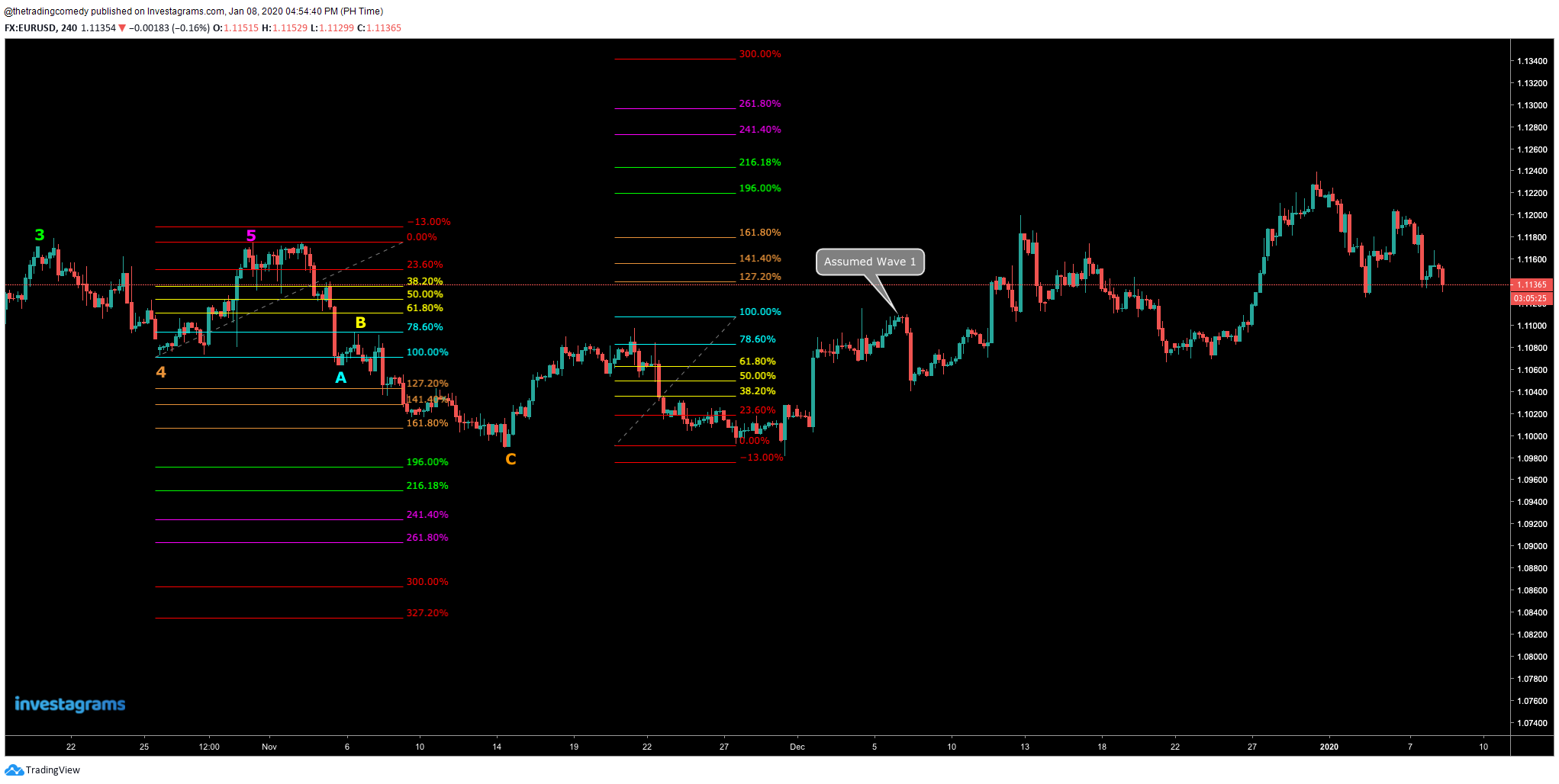

He takes a step back and watch the planet from afar. He goes back to the war room, plans his next actions, then waits for the perfect time to enter the mission again.

And now he waits…

That’s his way of protecting his people.

Let’s see the results:

Another scenario would be this:

So wait, whenever an army tries to enter a planet are you basically saying that they are fighting a war??

Well if you observed what happened in his journey at planet $JFC then yes, he just led his troops to a warzone. As you can see, you are not the only army exploring the planet hoping to rescue people or gather resources or whatever your objective is. You have other armies (traders/brokers) in the area probably after the same objective.

Wait a minute, I thought the stock market was kind of inspired by Dante Alighieri’s Divine Comedy where’s that part?

Patience reader, I just gave you one way of viewing the stock market: a strategic war game. Isn’t it surprising that you reached this part and you never got bored reading this blog? If you didn’t get bored at all, then let’s proceed.

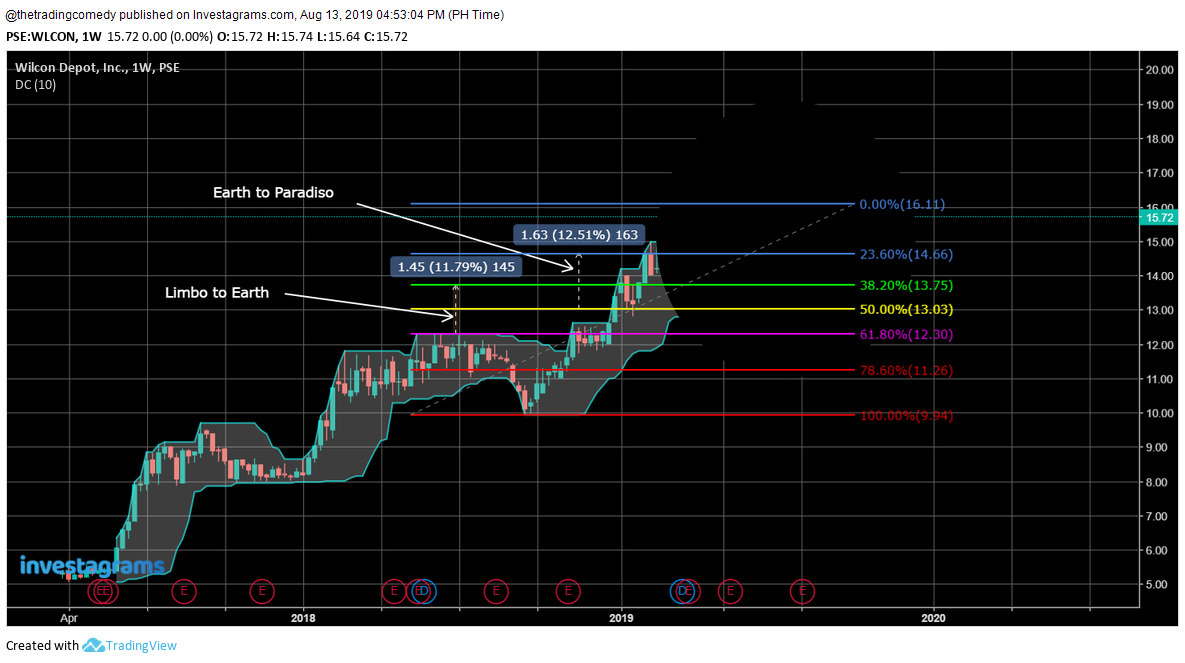

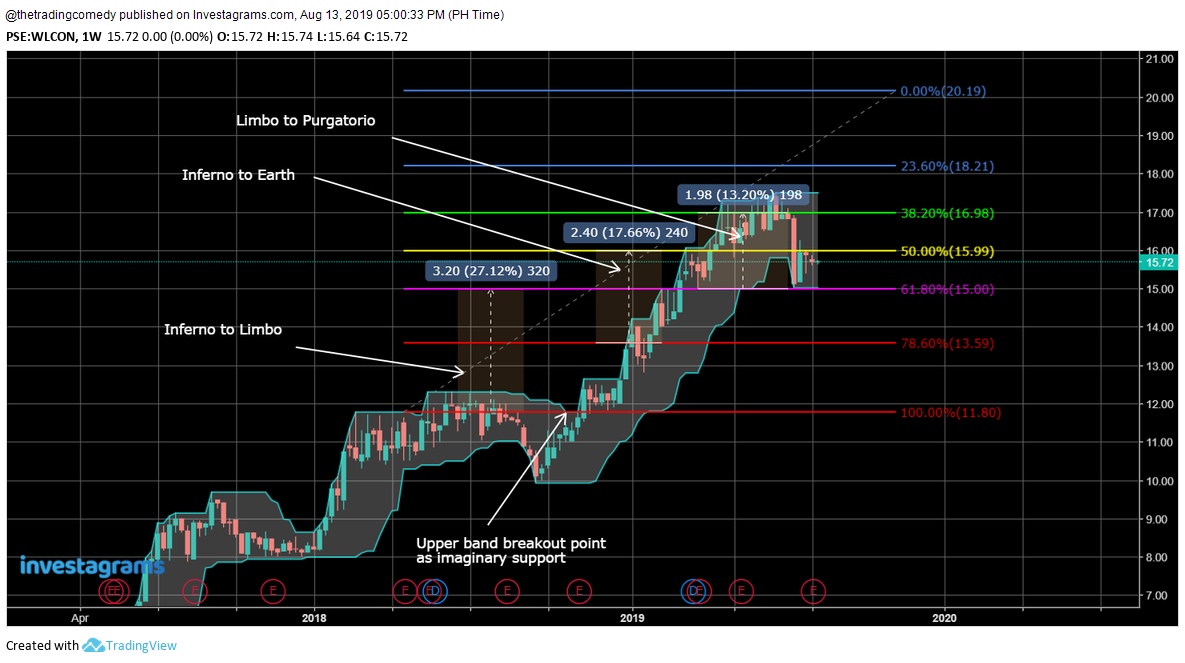

Here’s the “Divine Comedy” part (well I kinda gave the reference away in the first part but anyway… 😂)

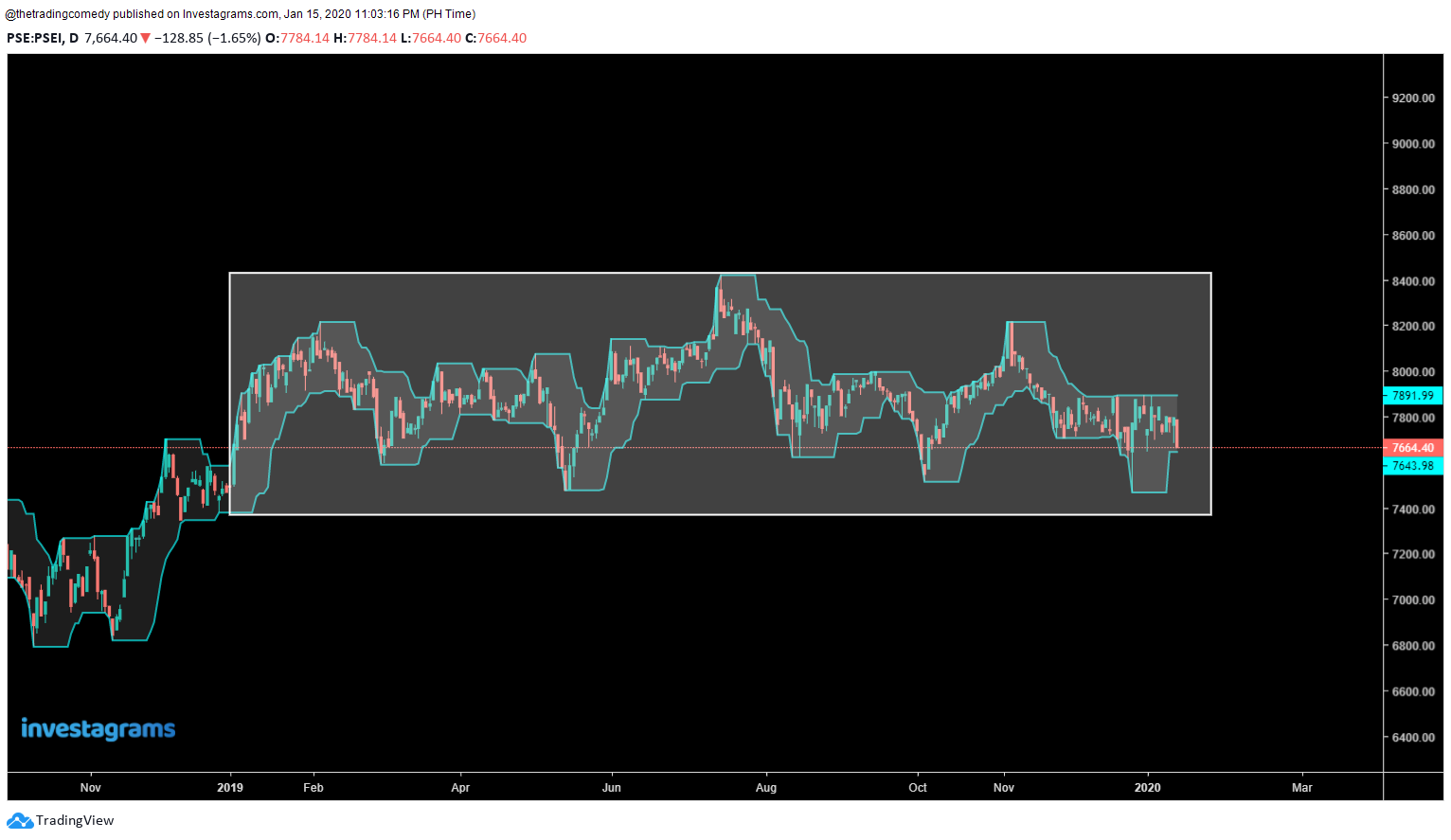

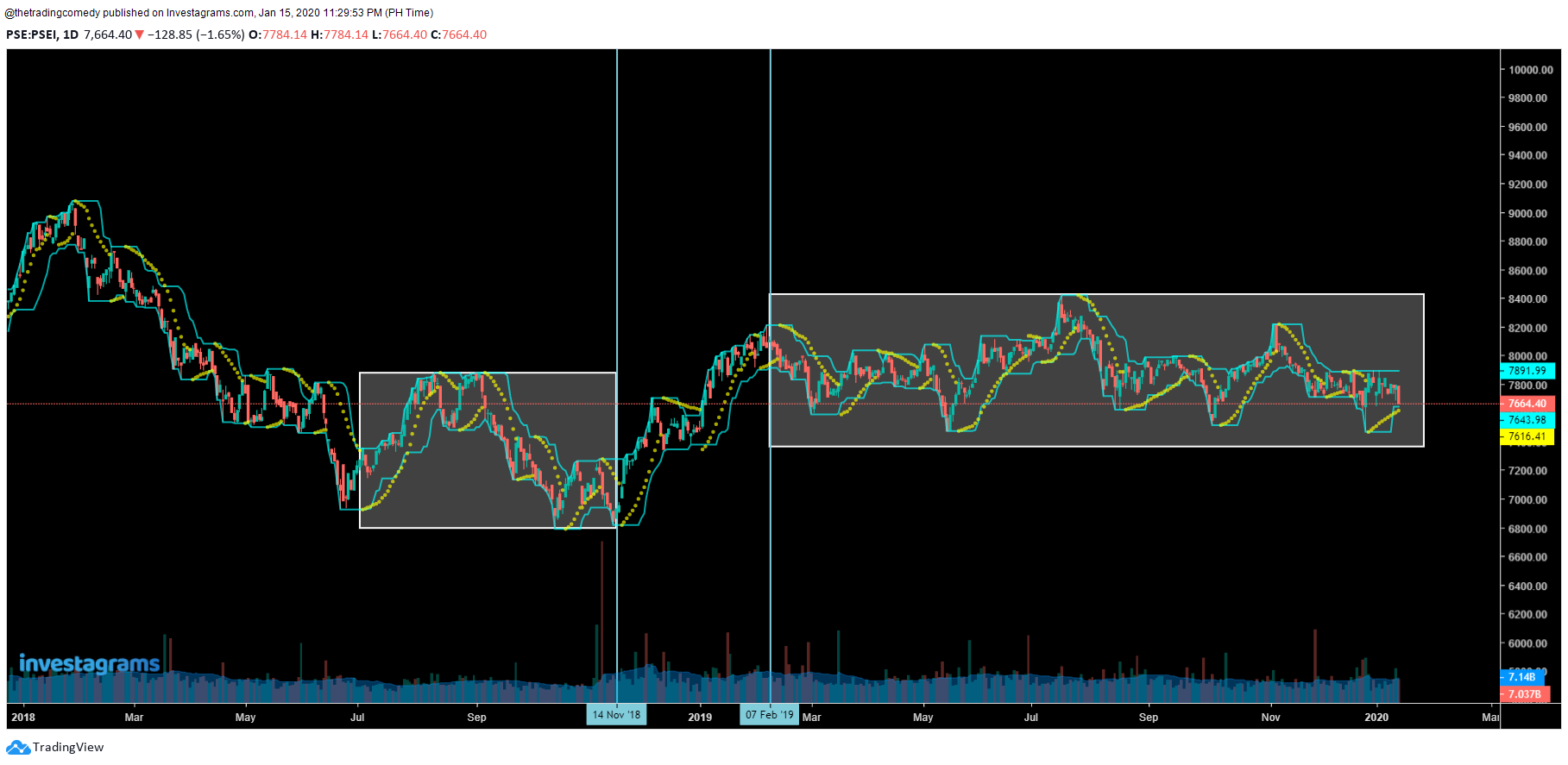

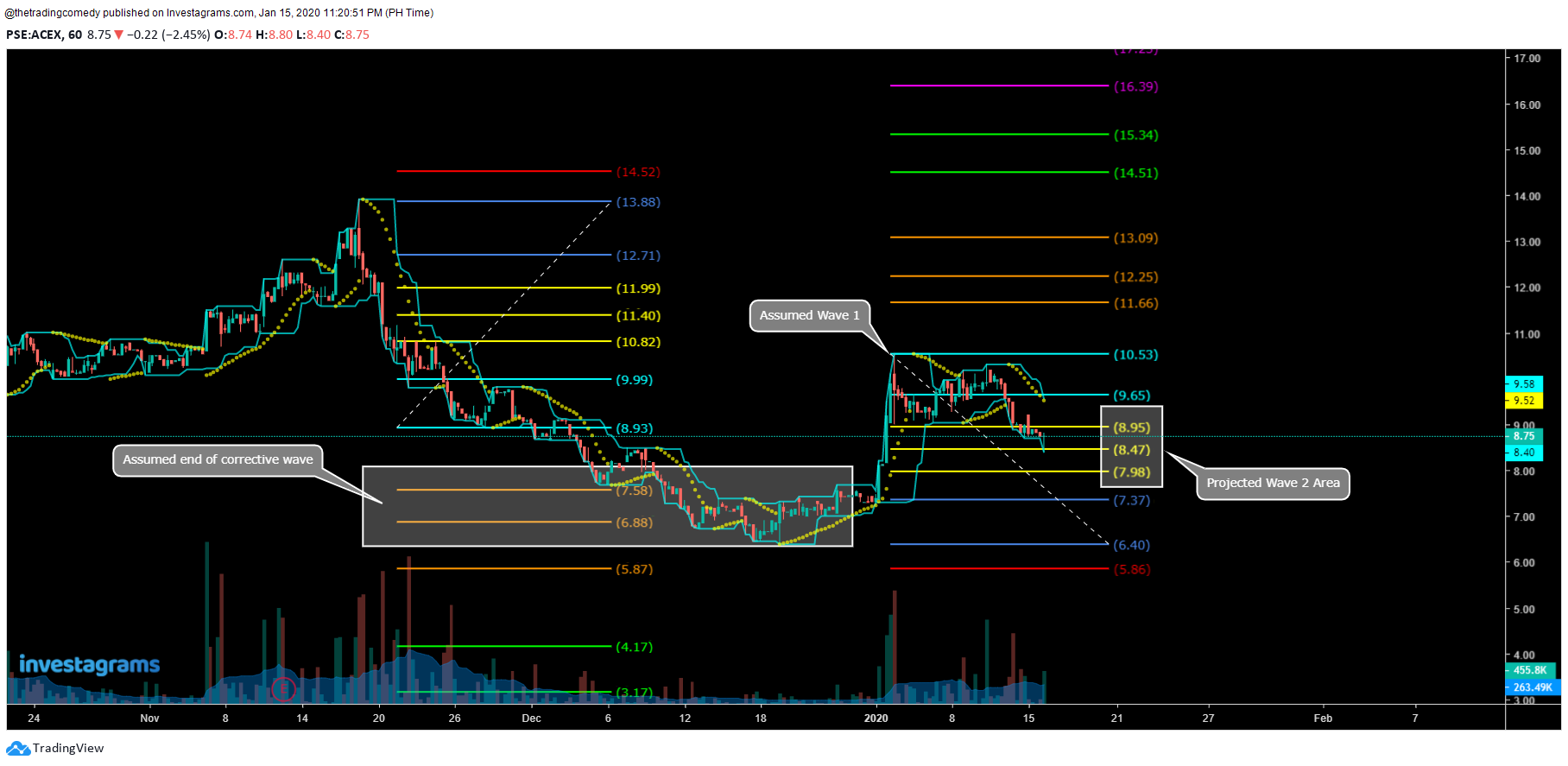

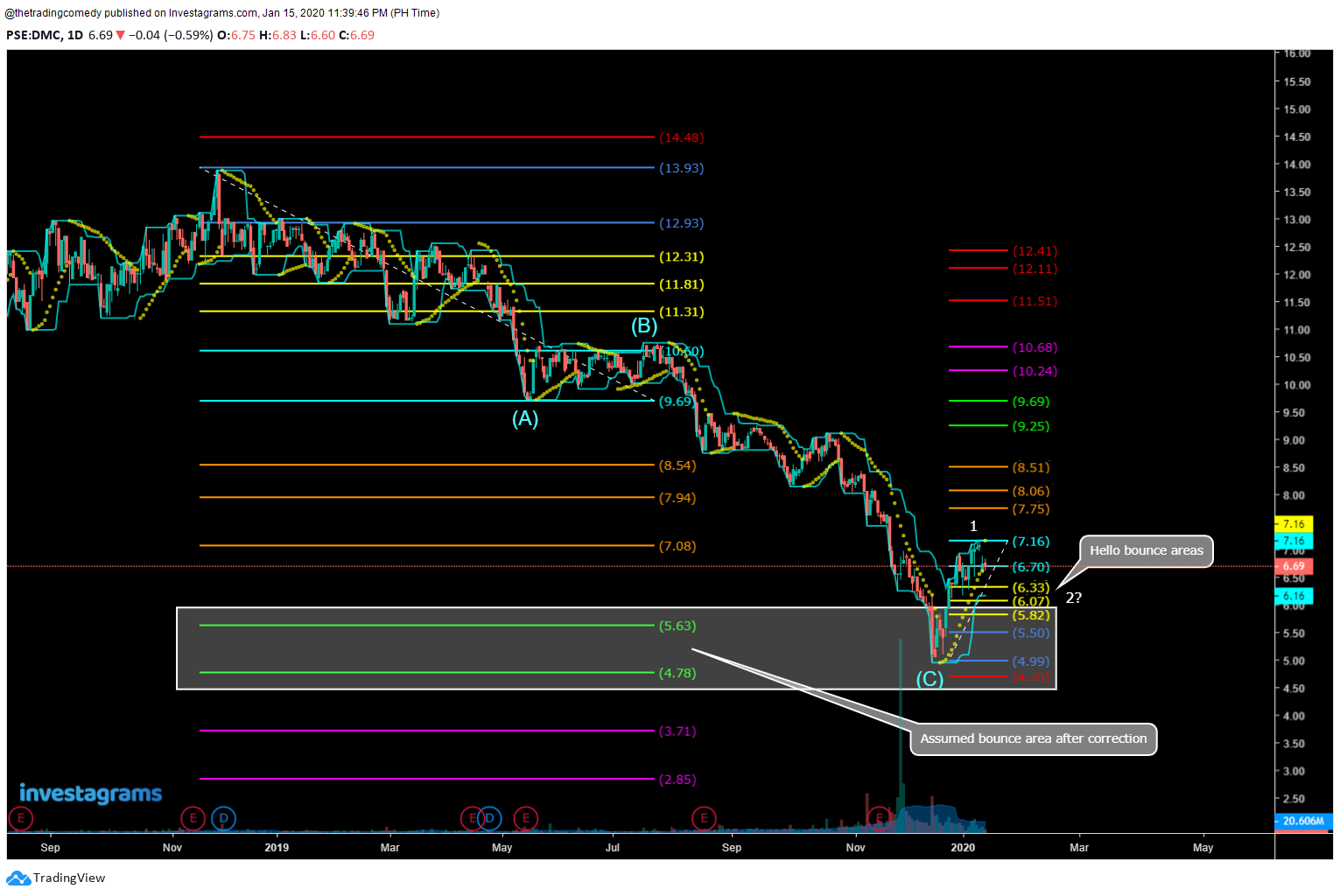

The stock market can also be like staring at a piece of artwork if you know how to have some sort of appreciation for it.

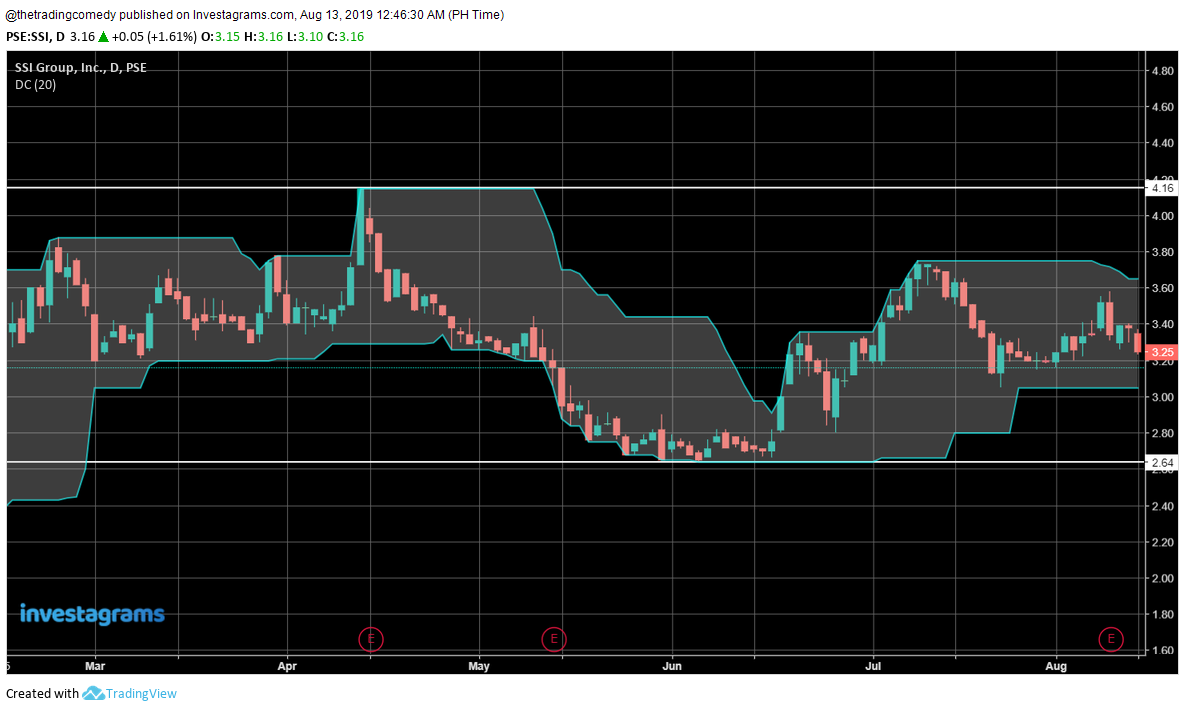

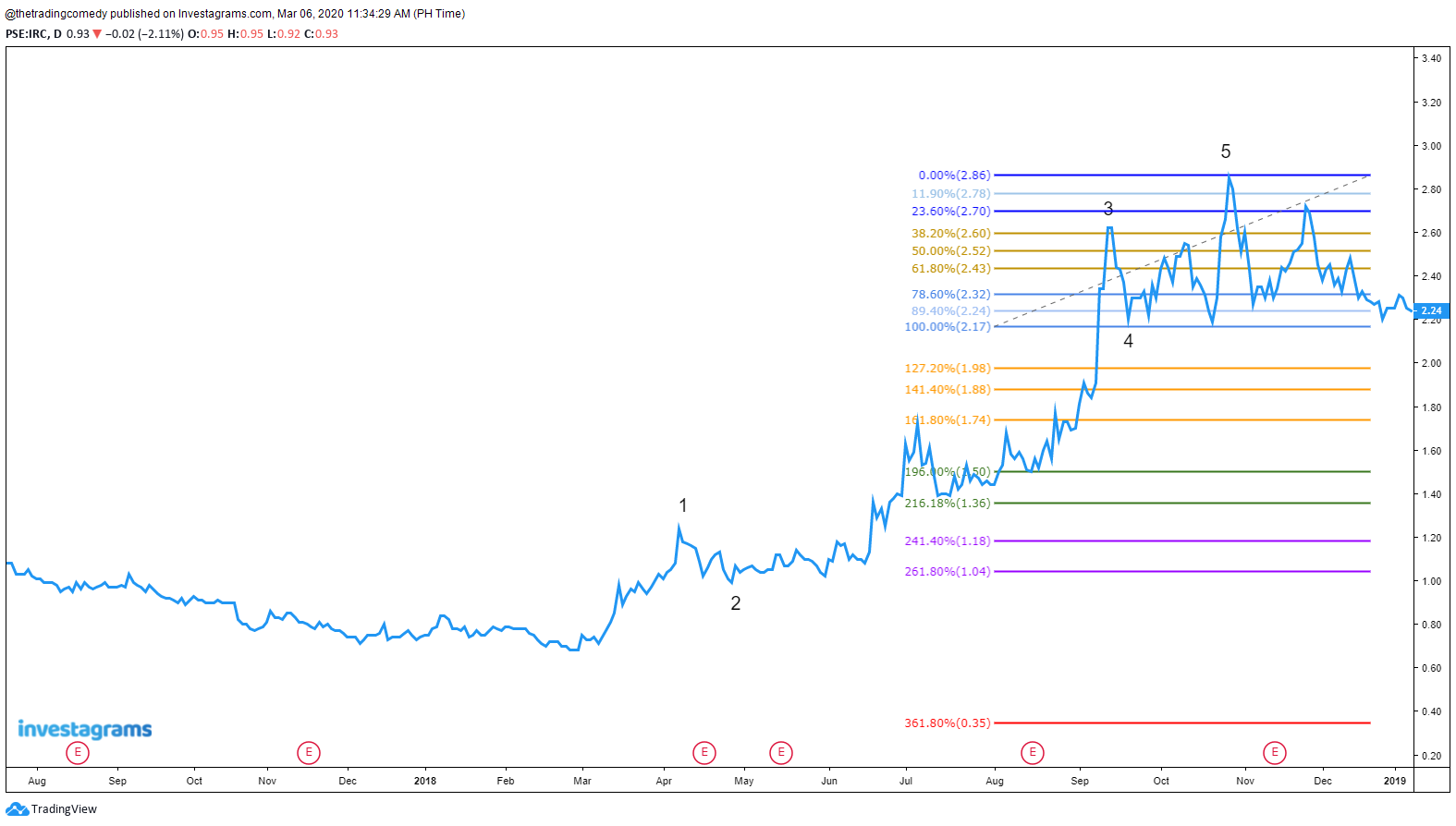

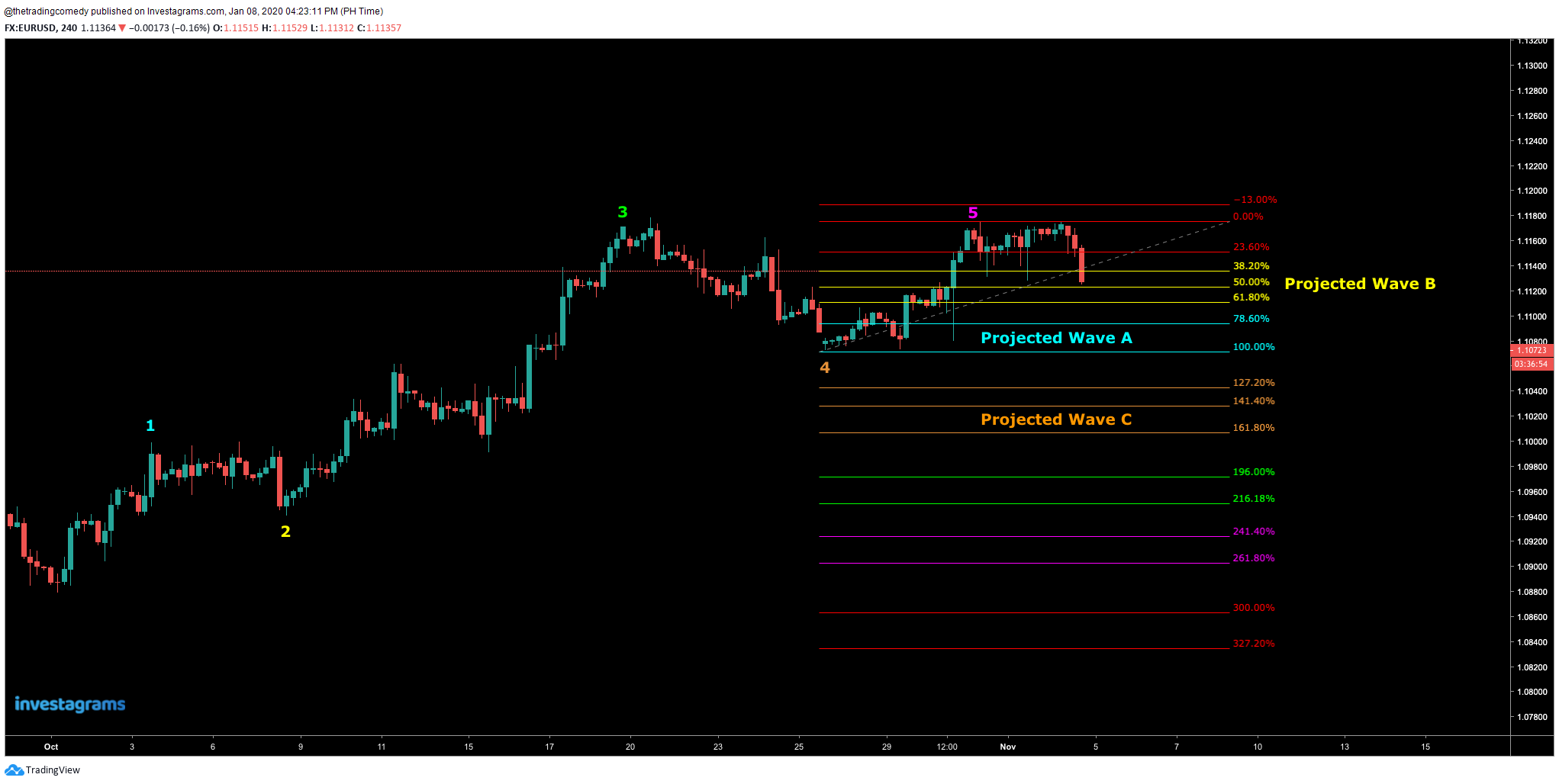

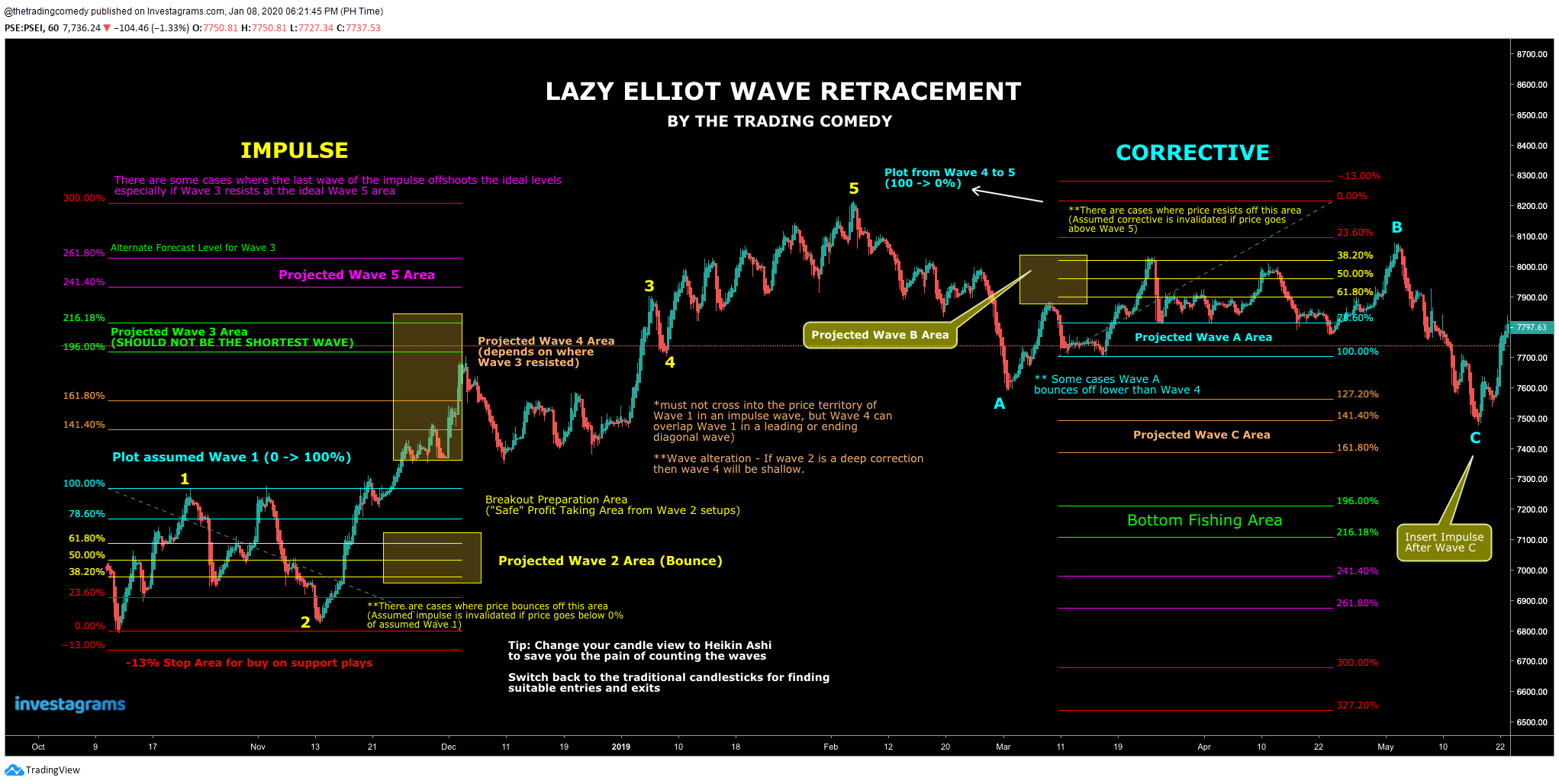

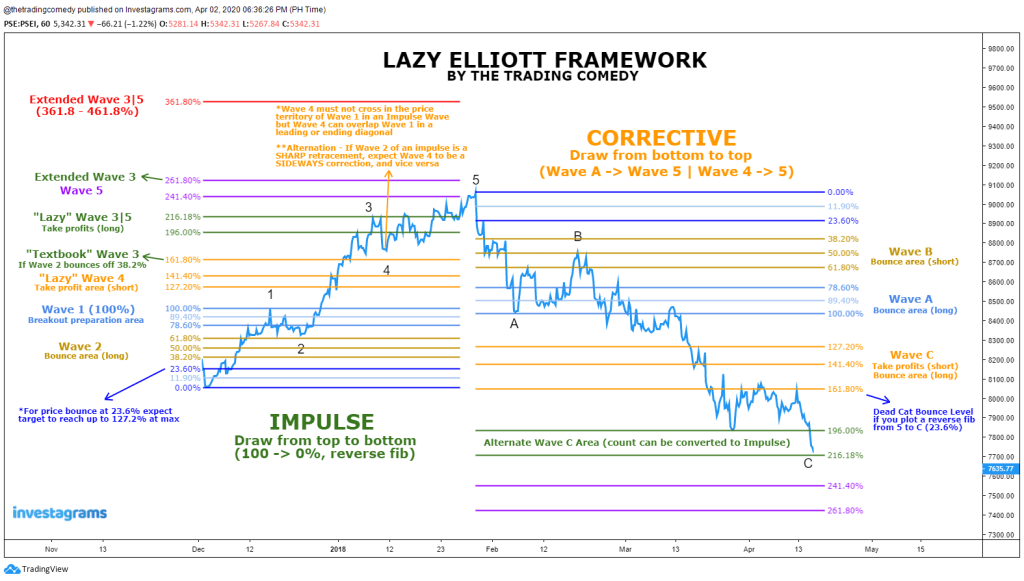

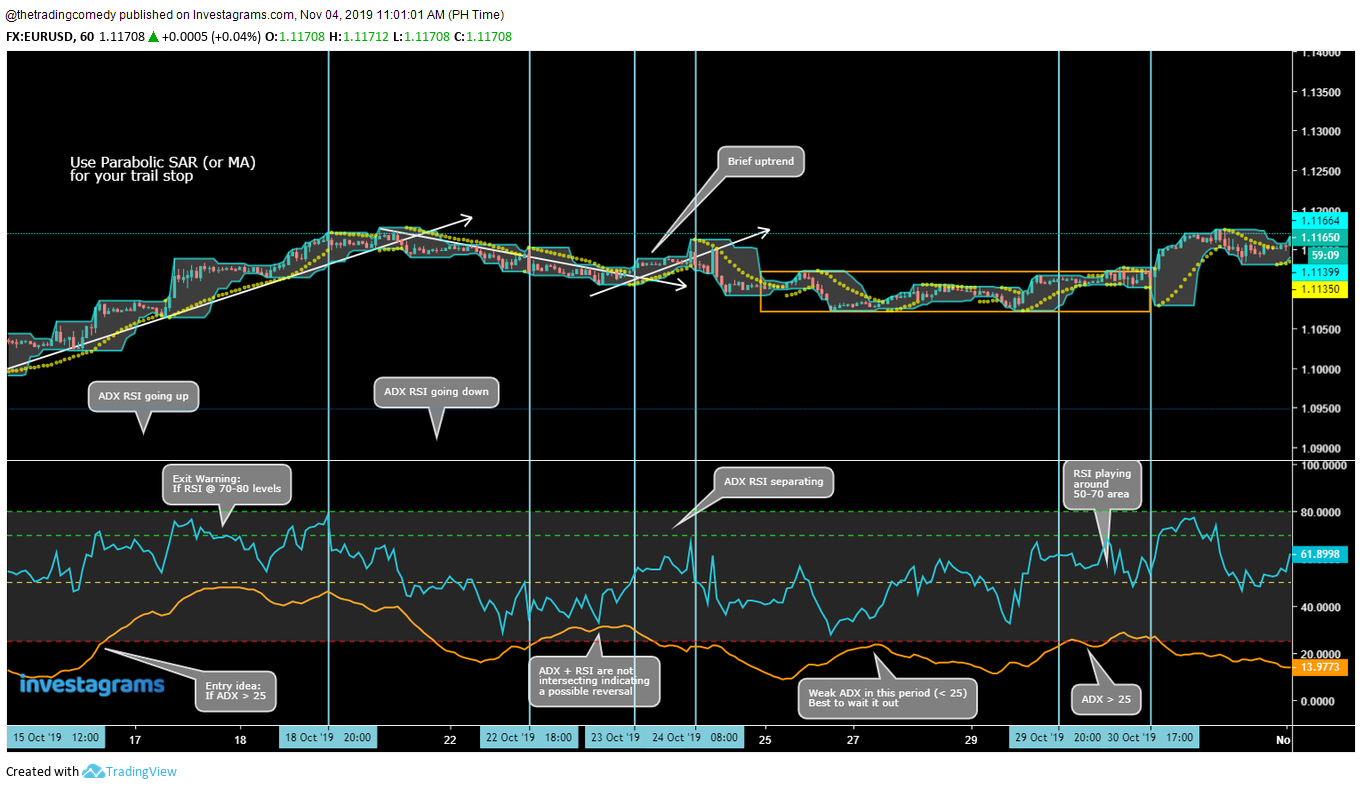

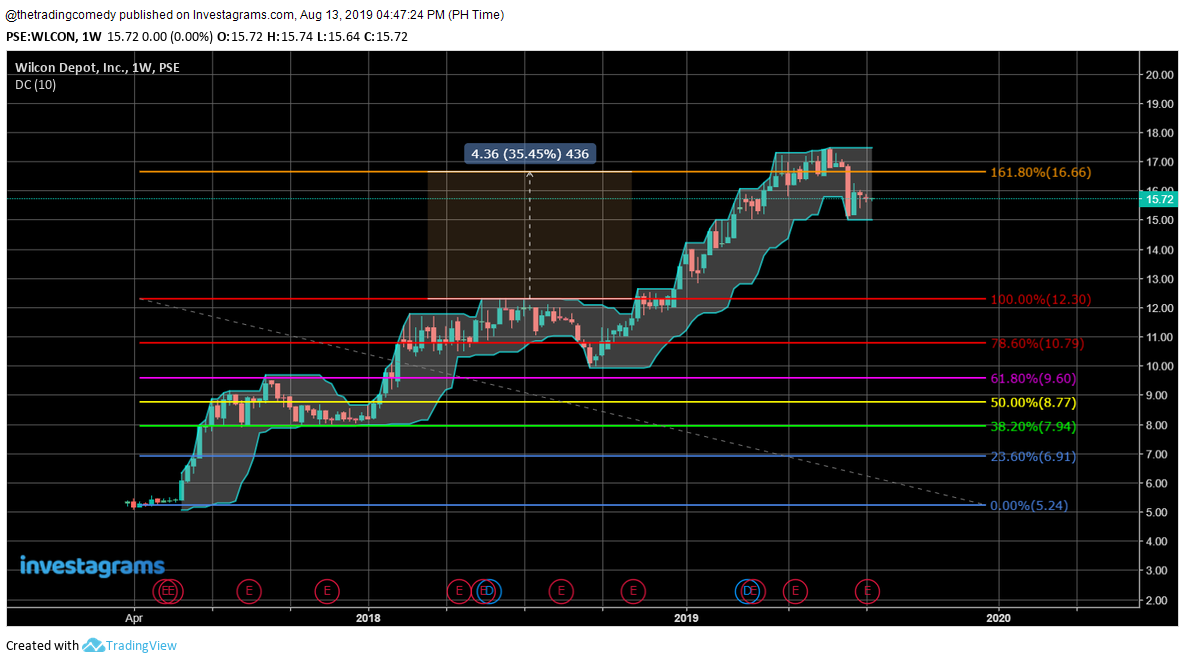

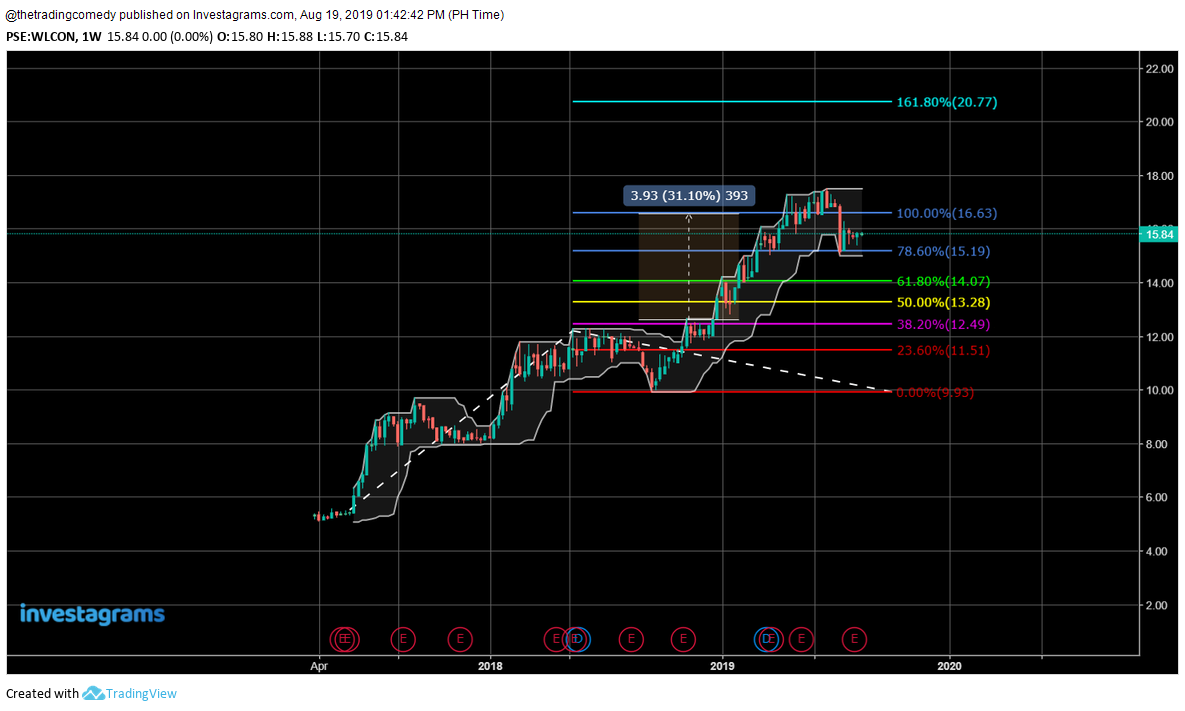

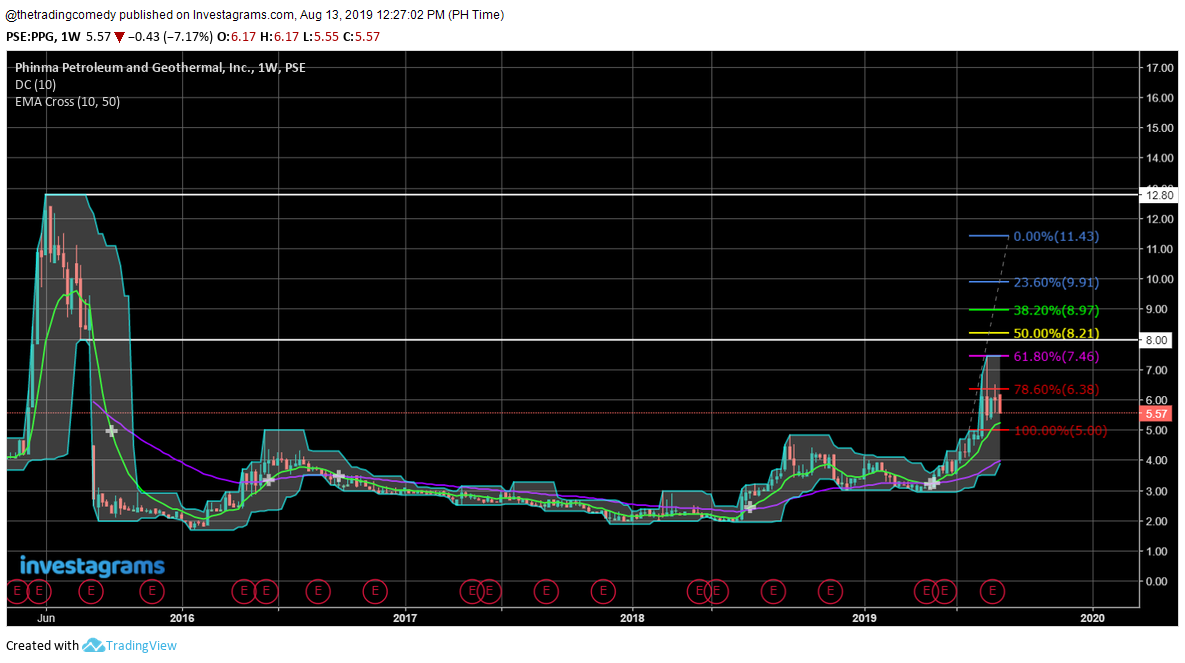

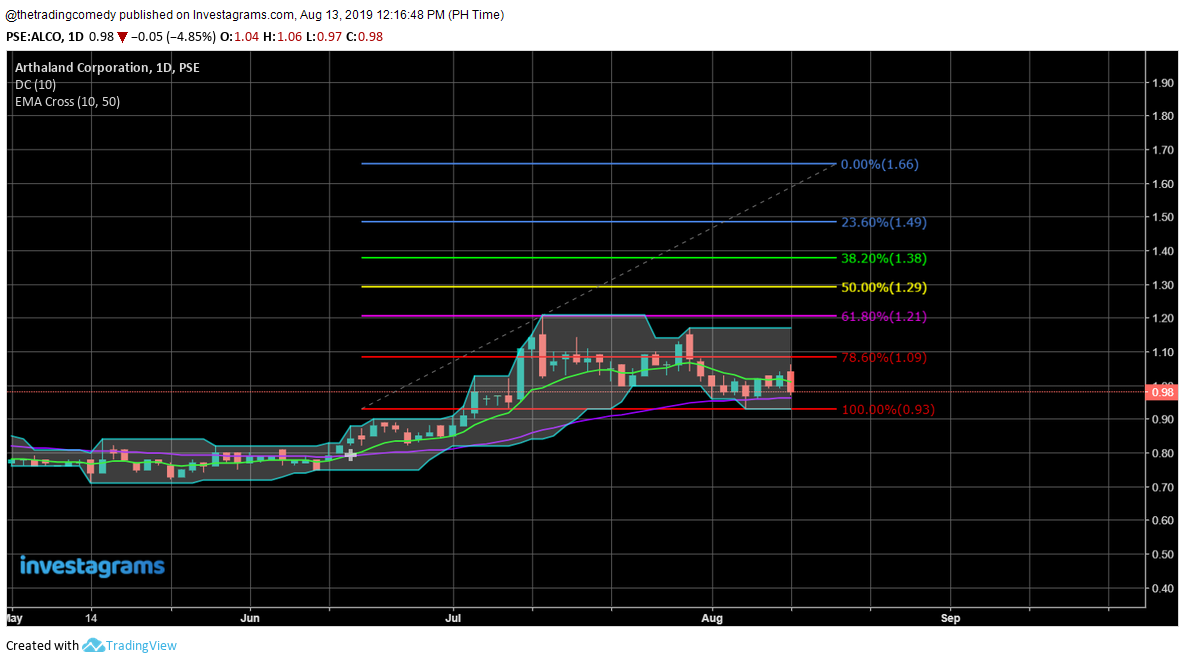

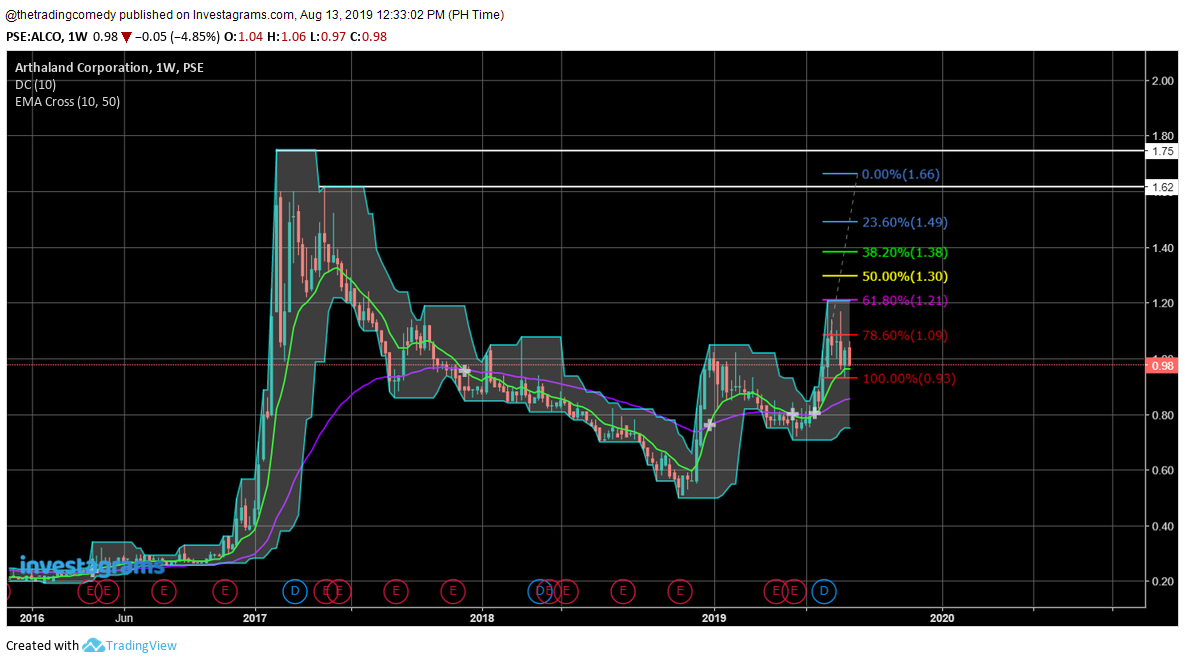

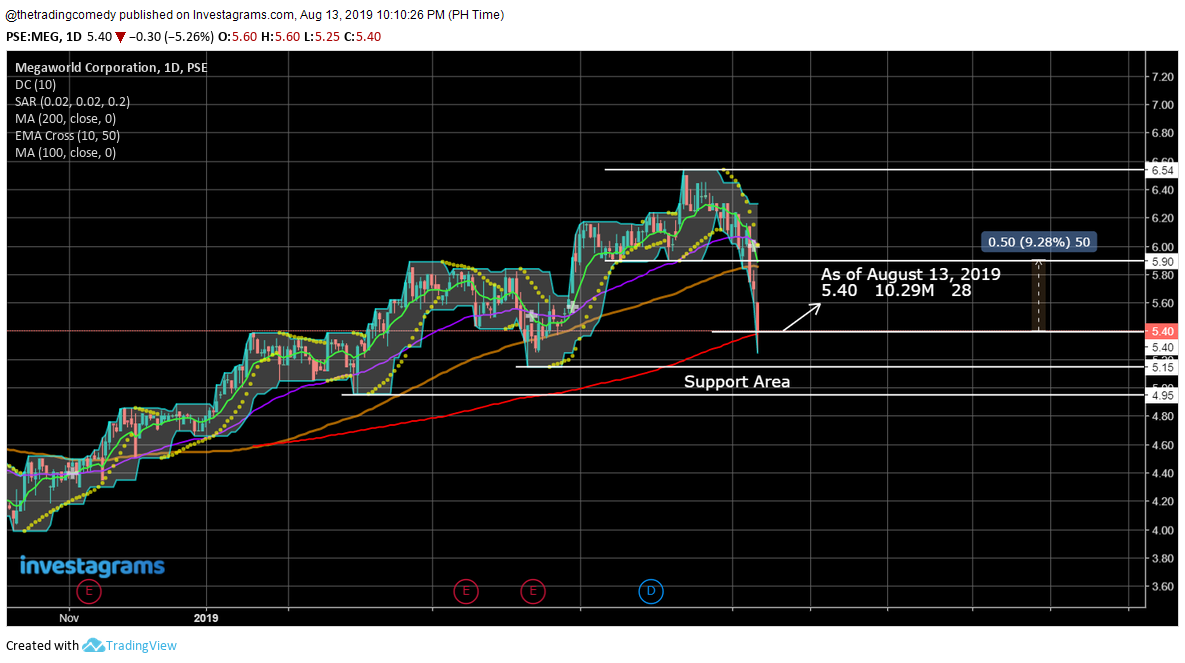

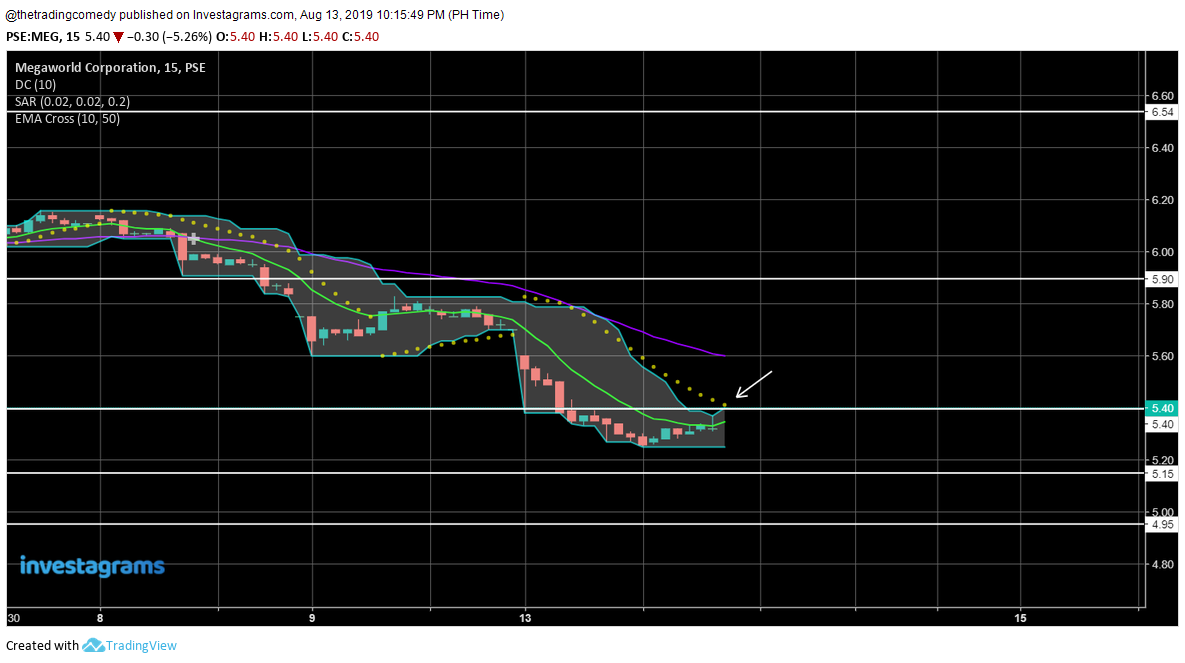

One way of looking at it is through risk management. And guess what? I have a video for that. But to give you an idea, it looks something like this:

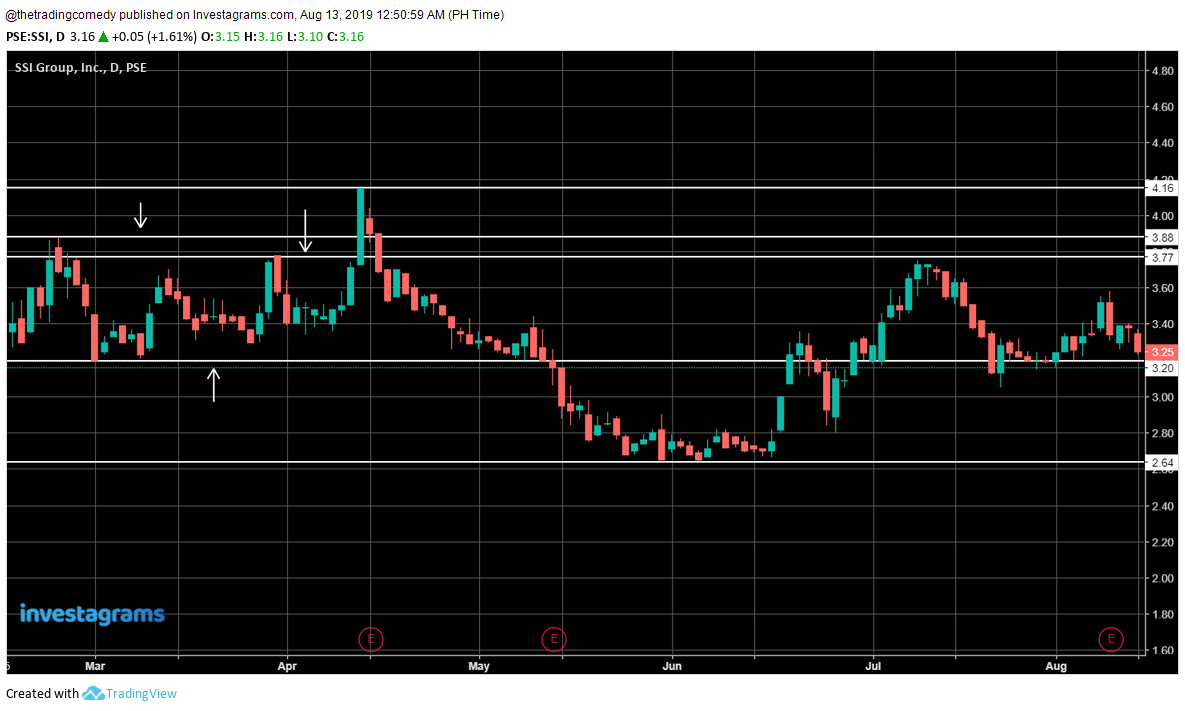

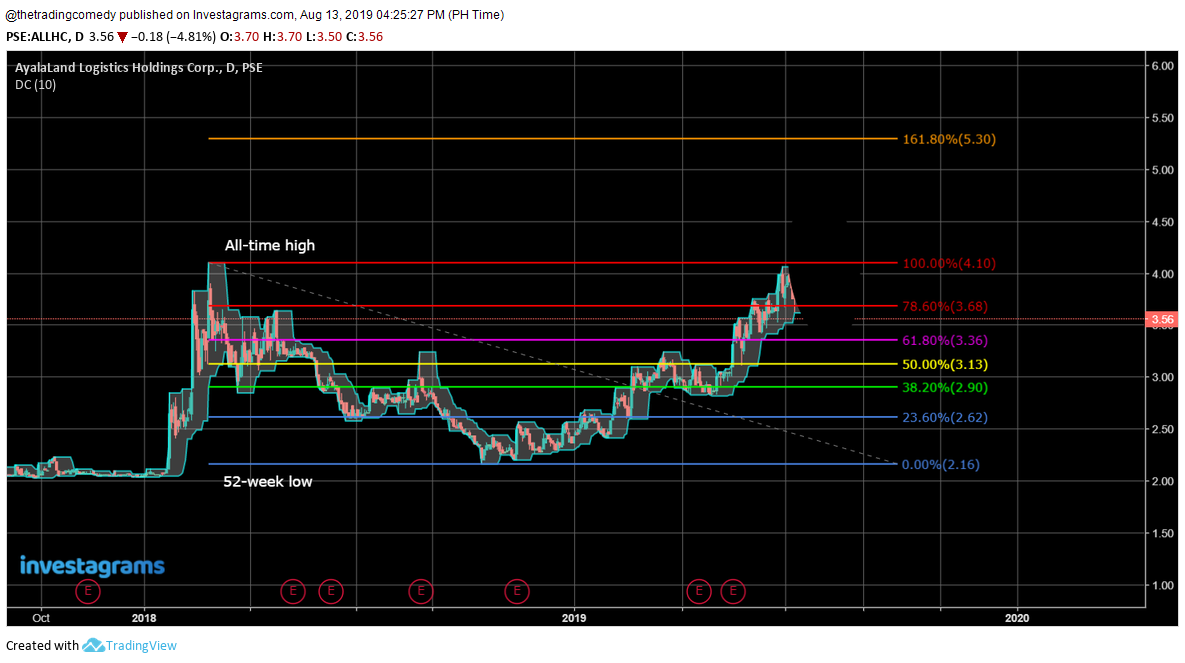

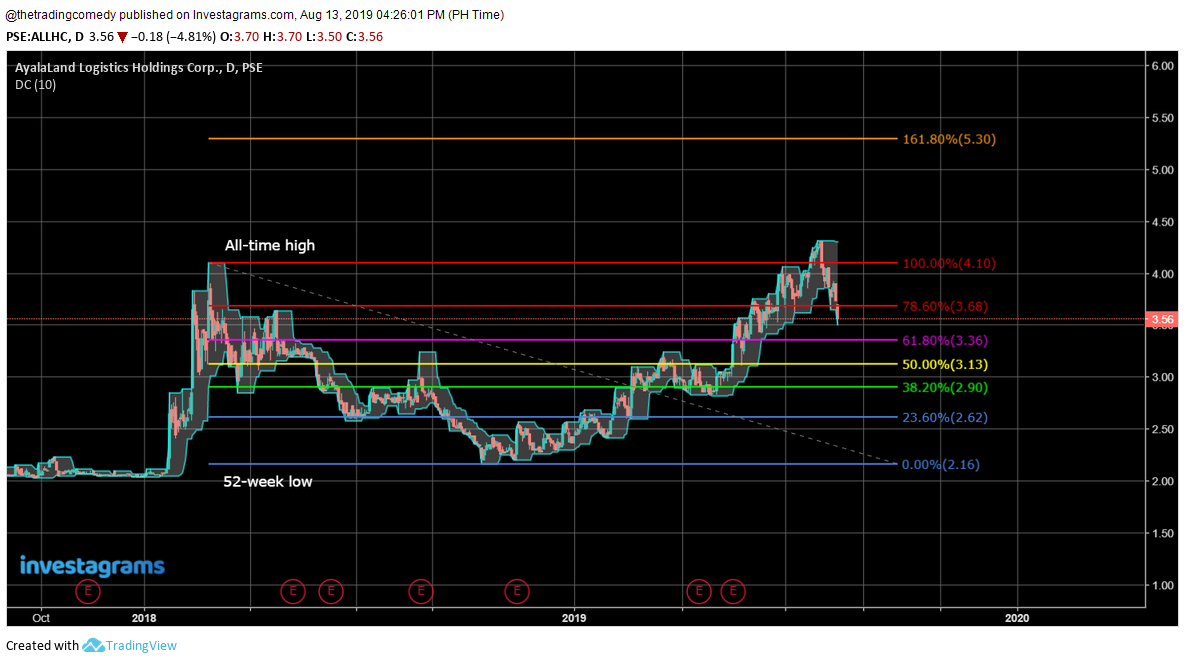

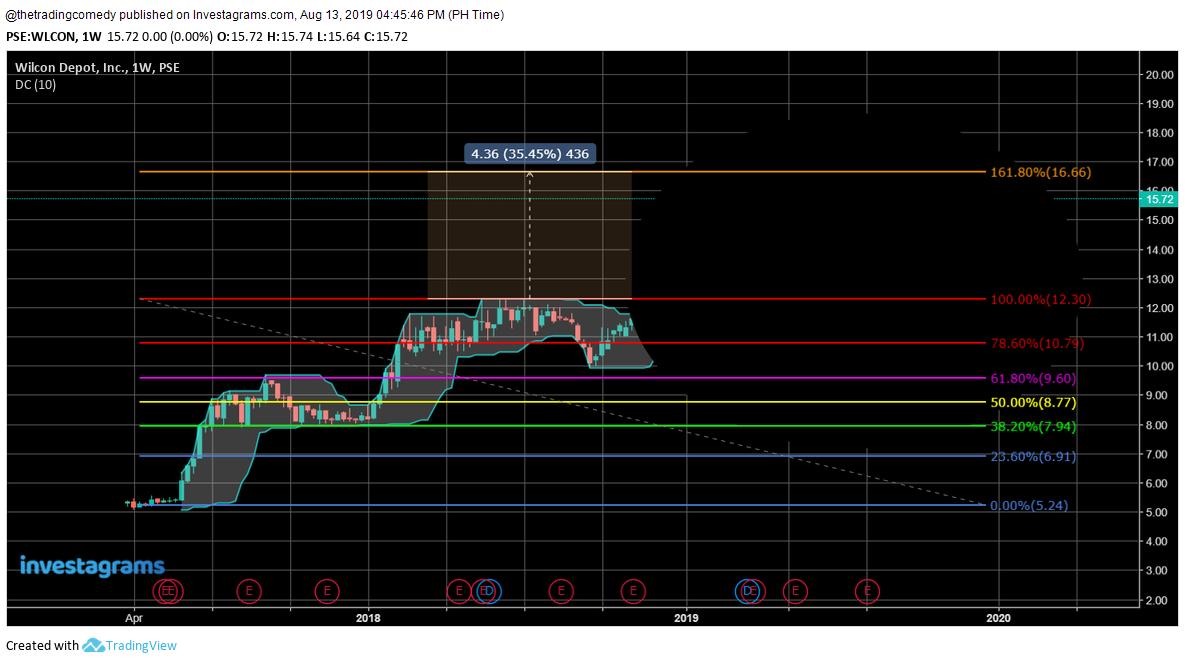

But wait…

Like this:

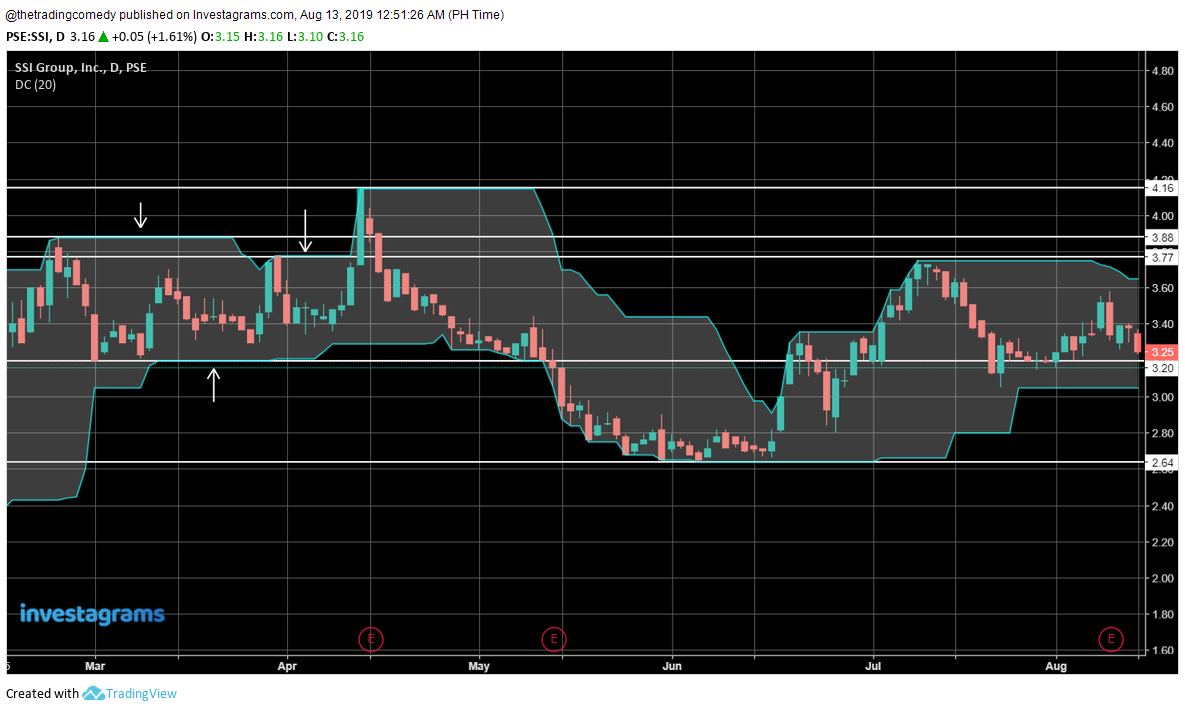

Whoa there! Did you just make me realize that you can ACTUALLY treat the Limbo & Inferno levels as SUPPORTS and Purgatorio & Paradiso levels as RESISTANCES??

Oh great you actually know what supports and resistances are? Nice! But for the benefit of the newcomers here, here’s what it simply means:

Support – A price level where people would most likely buy.

Resistance – A level where people would most likely sell.

If you actually noticed, I didn’t use the words SUPPORT and RESISTANCE until you reached this area of the blog (unless you noticed one of the figures mentioning those words 😂)

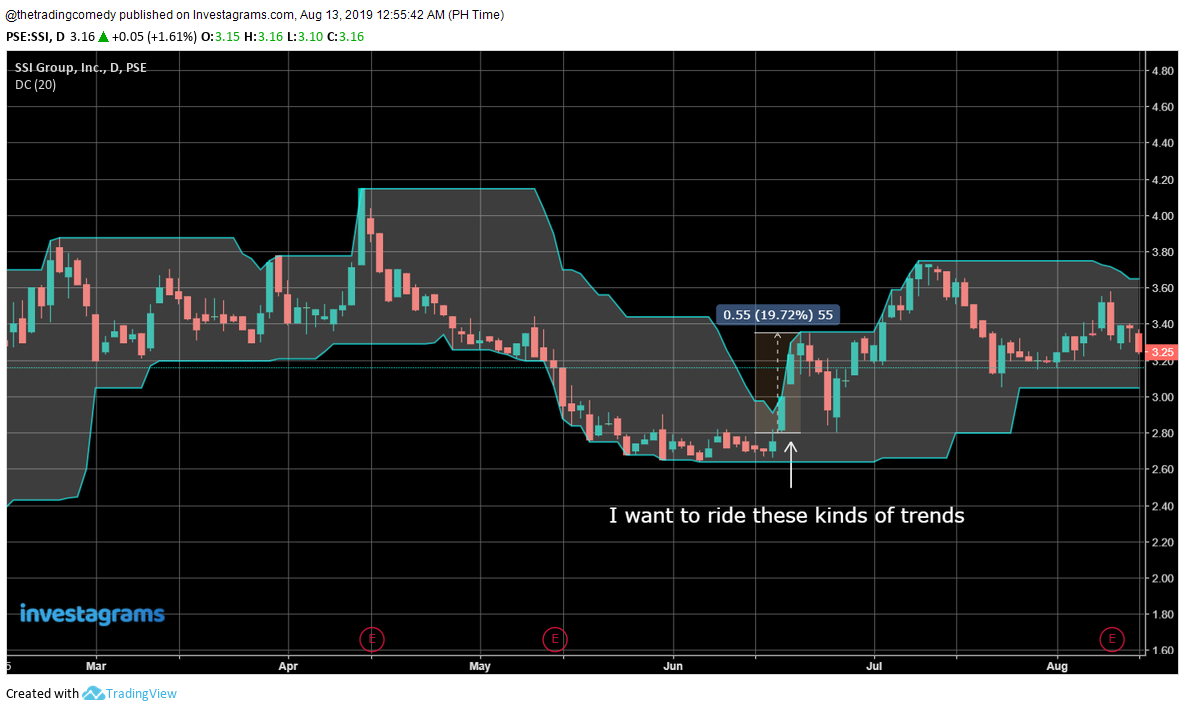

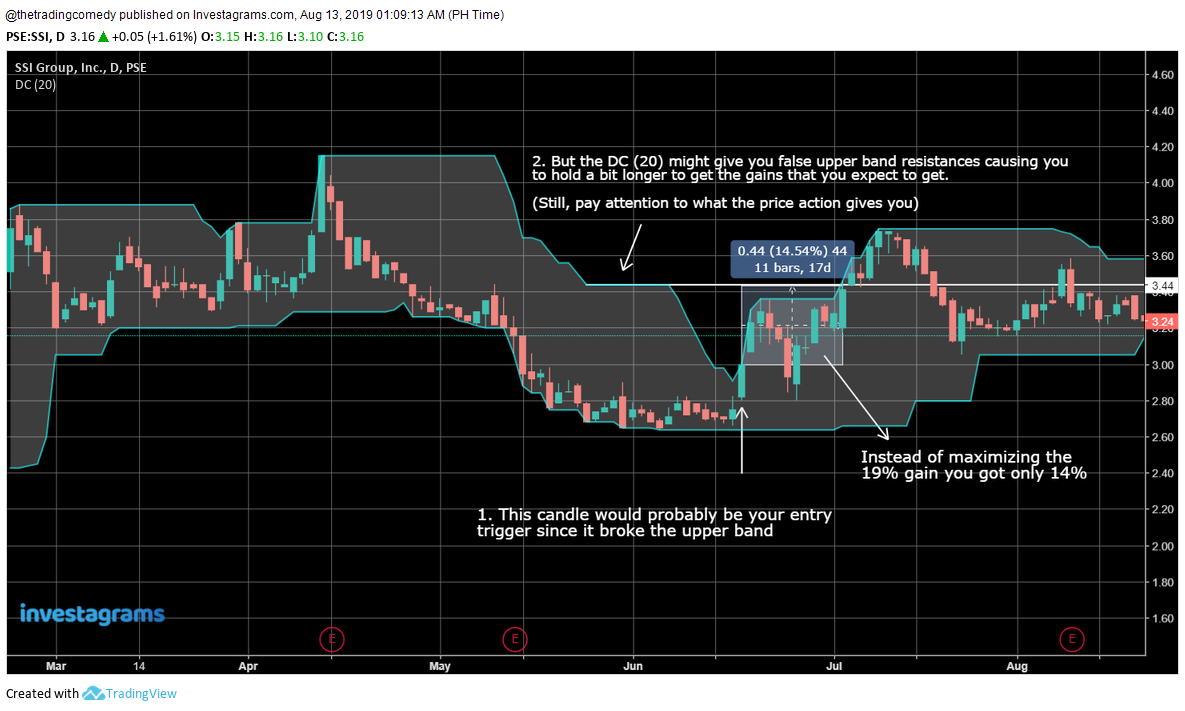

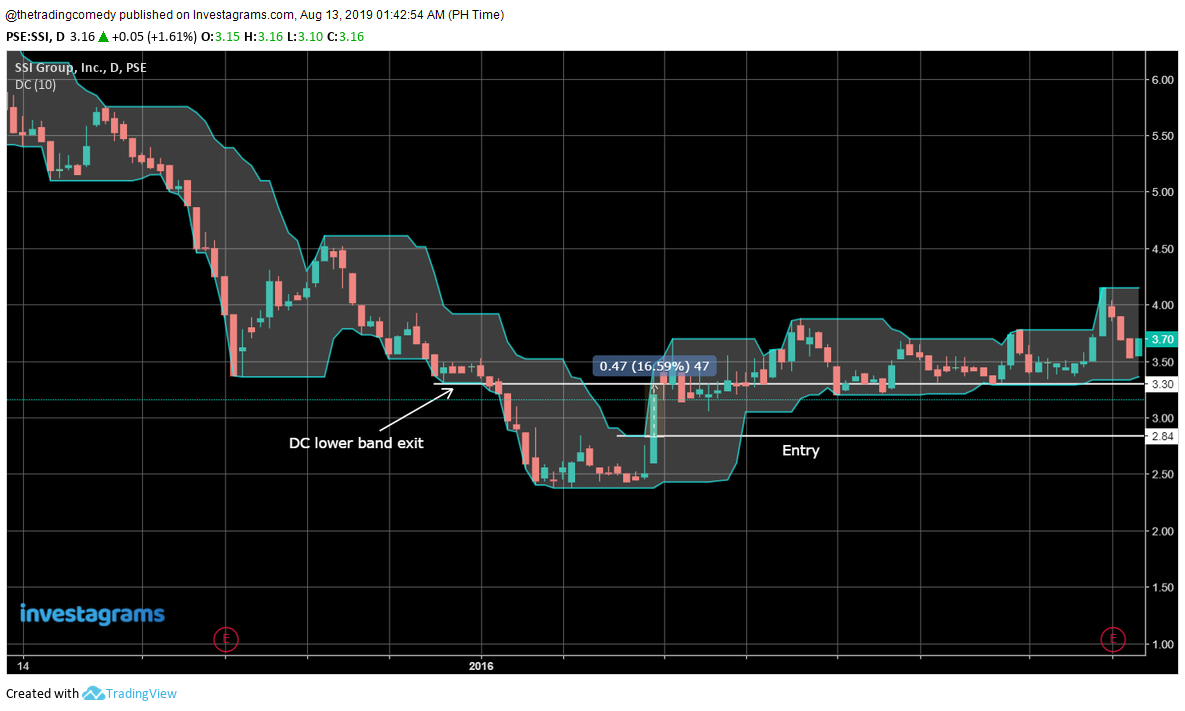

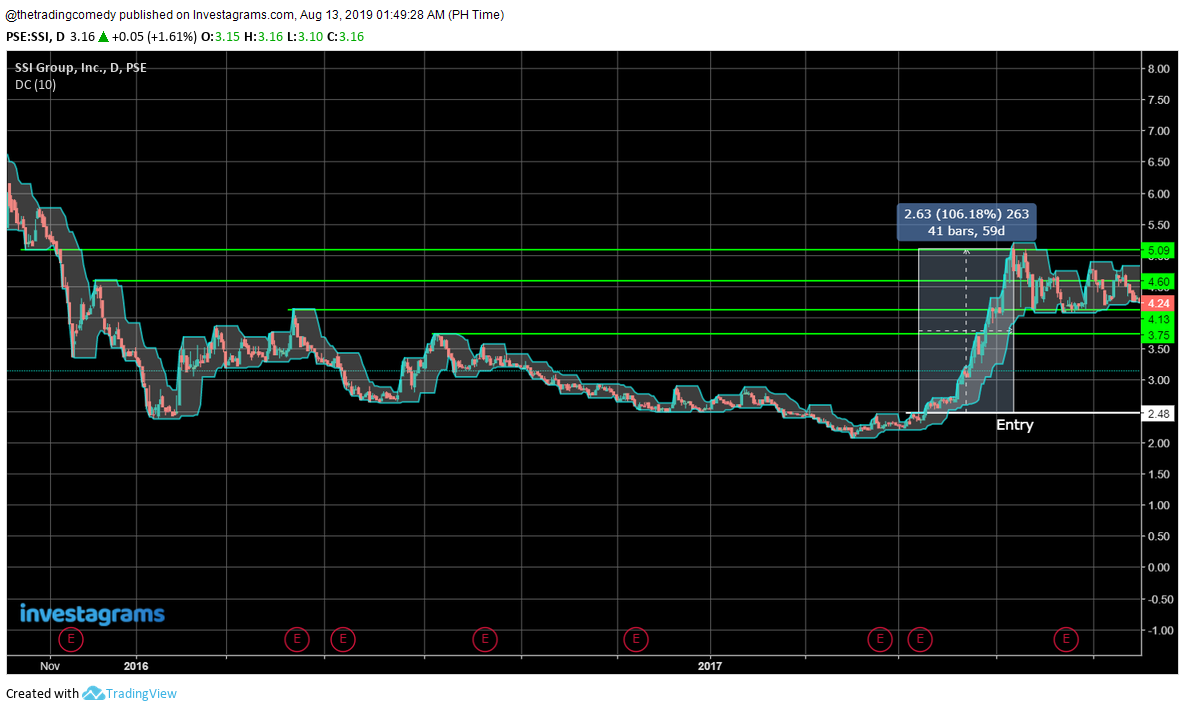

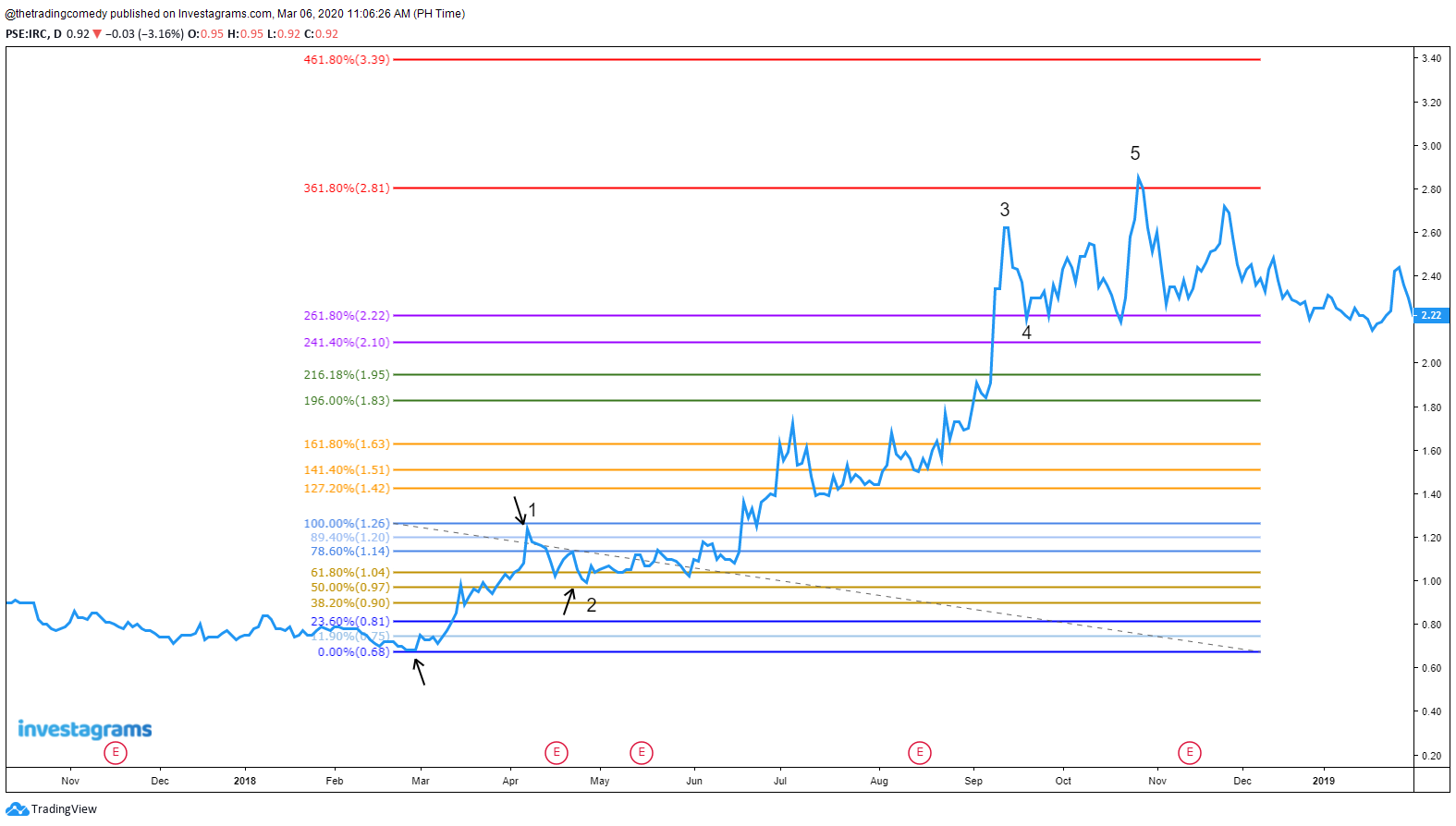

You see reader sometimes it’s just a matter of waiting and executing (and updating your plan, if necessary.)

Wait, you can actually use your past Limbo & Inferno as your Purgatorio & Paradiso??

Well, if you want to put it in stock market jargon, yes. PAST SUPPORTS can act as RESISTANCES and vice-versa.

So what is the stock market?

Logical, in a sense that you create a plan and you follow it. It’s simple really but most of us can’t pull it off because either we lack the discipline or we attach our emotions with our decision making.

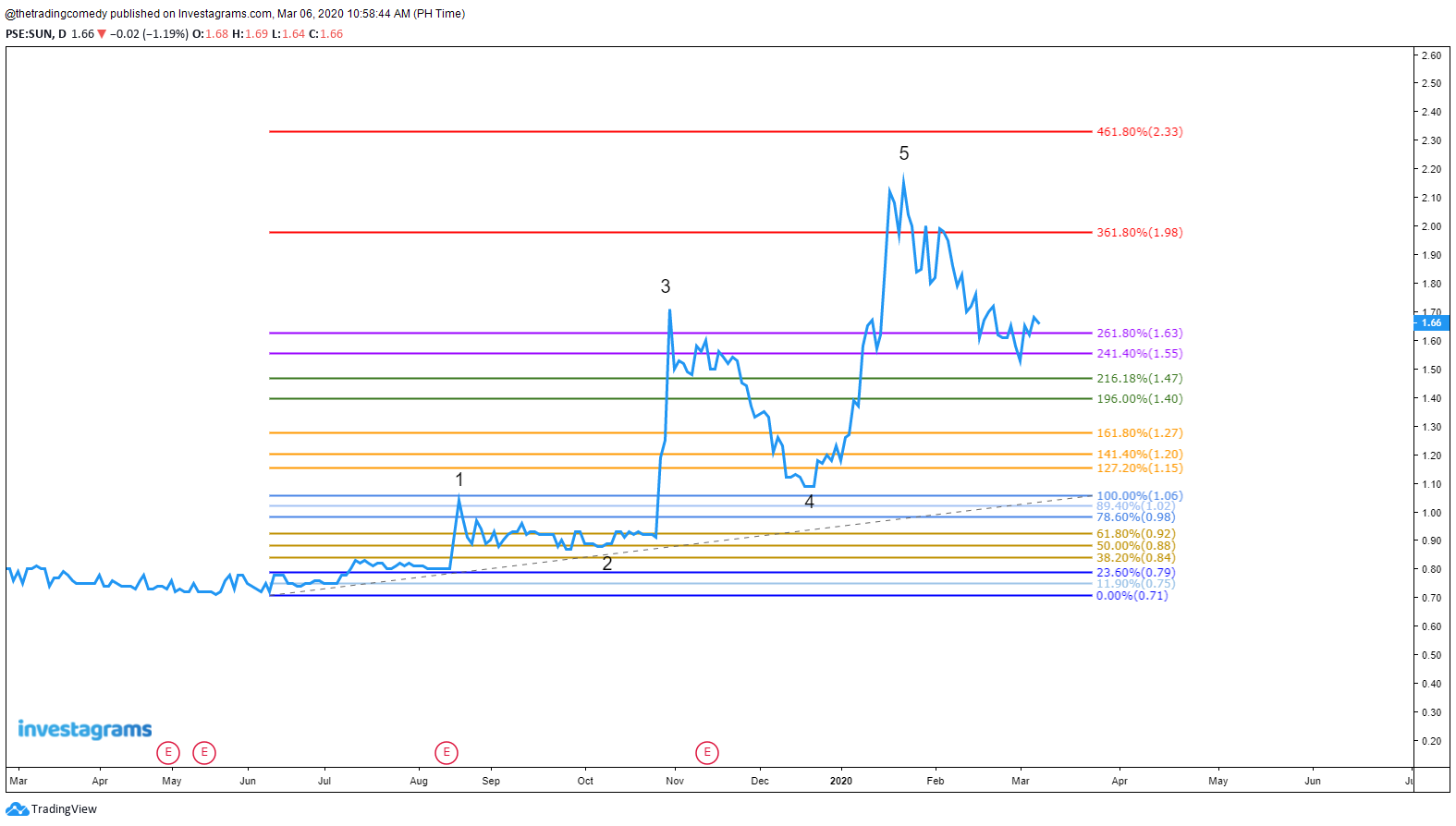

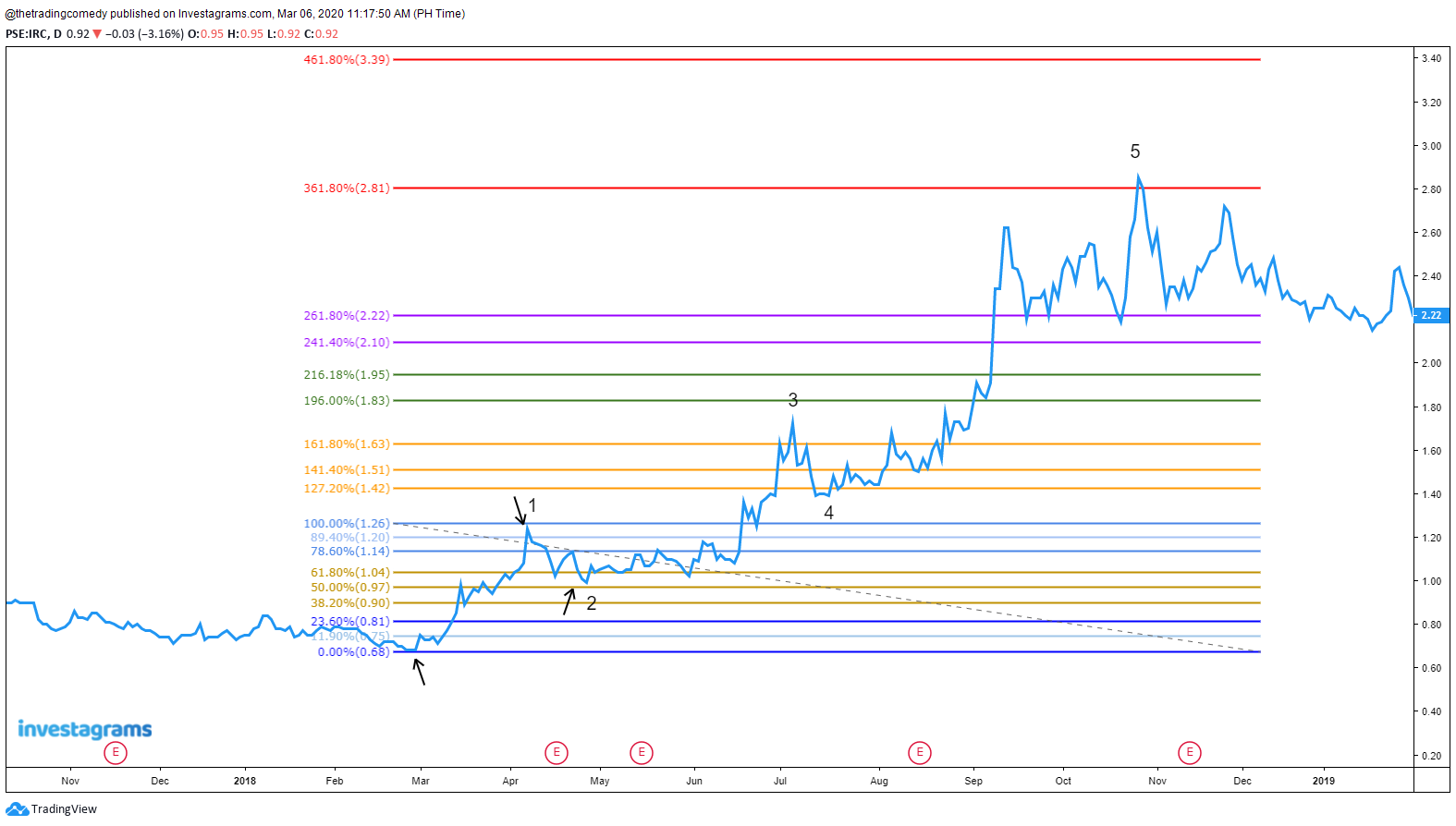

Artistic, in a sense that when you embark on this journey you will see a lot of planets, having the same patterns again and again probably lowering your risk of losing big in the long run. You’ll probably see it more once you start recording all your trading adventures. And please do yourselves a favor and start recording your trades. DON’T MAKE THE SAME MISTAKE THAT I DID.

If you’re lazy to create an excel journal template you can create an account here at Pltrades (if you’re trading at the PSE) and probably follow me there if you want to see how I do in the PSE universe

Profit? Hmmm well, if you’re not ready to face these kinds of statistics on your first months/years of trading then this may not be for you.

You’ll get to a rough start…

On some days, you would think you got it already.

Some days you’ll get confidence boosts like these…

And these…

Some small losses and big wins here and there…

More big wins but your ego takes over and you suddenly take in bigger losses

And then you f*ck up 🤣🤣🤣

Oh yay trading so fun… 😅😅😅

You might be wondering how I manage to trade a lot? It boils down to risk management and proper volume allocation.

I never go all-in. I enter what I can tolerate to lose/gain. I treat money like they’re my soldiers.

On the bright side, if we manage to be profitable in this endeavor, there’s actually no boss to report to but yourself/myself. There are no employees to manage but yourself/myself.

Basically, this job is heaven for introverts. But if you’re an extrovert, that’s fine too. Find a trading support group. 😂😂😂

Why do a lot of people say that entering the stock market is considered gambling?

Entering the stock market would be considered gambling if YOU DON’T HAVE A PLAN.

Sounds like a challenging business to venture out in, so where do I start?

There’s an online trading platform called Investagrams and they can let you create an account for free and you can practice chart analysis there (and did I mention they have a virtual portfolio where you do paper trading without risking real money? Isn’t that awesome? 😁)

When you think you’re ready, go on and open a real trading account and be prepared for the worst.

I am not kidding here: the feeling of putting real money in this game is way different than your usual paper money. If you manage to keep your cool, then great!

If you want to know more about my trading styles then feel free to explore this playlist and subscribe to Pewdiepie (or here 😁)

Good luck reader, and see you on the trading field!

WELCOME TO HELL! 😁✌

Your Trading Poet,